If you hit the rewind button back to a year ago, gold was trading at $1,850/oz, and the iShares TSX Gold ETF was about $19.50. Now how would you have responded if asked how gold and gold equities would perform in a year that would see:

1. The pandemic getting worse.

2. U.S. & Canadian Core Consumer Prices rise by 5.5% & 2.9%, the fastest pace since the early 1990s, causing inflation to become a hot topic.

3. Real yields remain pinned below zero.

4. Meanwhile, expansion in the global money supply would continue growing.

As humans, we love x → y, or simply causality. It makes our lives easier – simple rules to help the decision-making process. Such as if there’s inflation, gold is good; everyone knows that one.

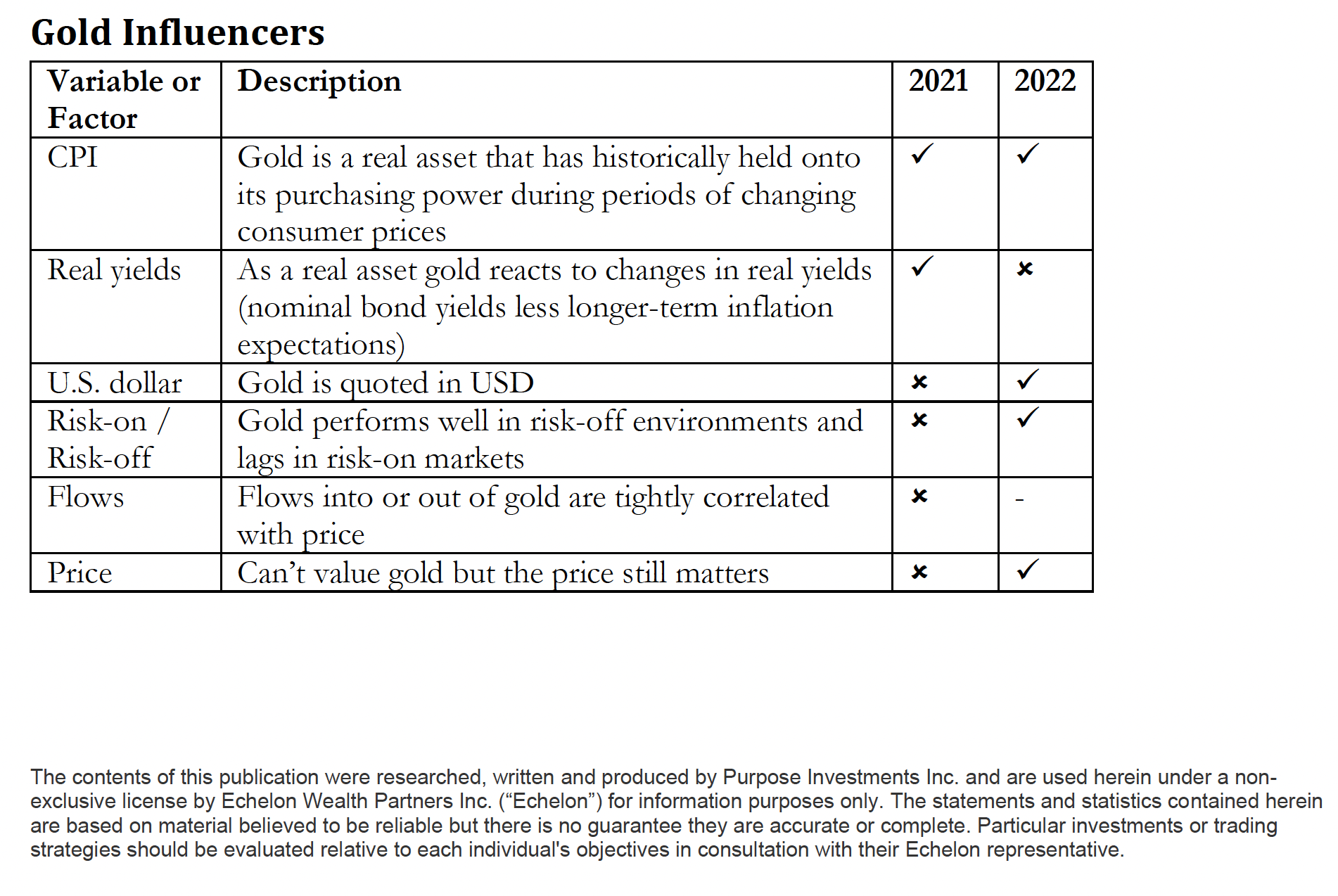

Unfortunately, causality rarely has only one variable in the world and especially in the financial world. This was the long version of ‘it’s complicated.’ Gold isn’t broken, and there are many other variables at work. So, let’s go through some of the big ones to help put 2021 into perspective and see if we can get a handle on the outlook for gold in 2022.

Nonetheless, the highest CPI since the early 1990s was undoubtedly a positive factor for gold in 2021 (see in the table it gets a ✓). The big question is what will happen in 2022, which remains unclear. The bottlenecks contributing to higher CPI should gradually abate, caused by covid disruptions, strong demand, and abruptly changing behaviours. But so much stimulus has been injected into the global economy, which will continue to impact prices for many quarters to come.

Headline CPI is likely to normalize in 2022, but this normal will likely be higher than before the pandemic. And the longer it lasts, the more expectations about the future change; this is positive for gold.

Real yields: The benefit of discussing real yields is that it incorporates nominal yields and longer-term inflation expectations (not to be confused with headline CPI data). In isolation, higher nominal yields are not good for gold. Straight up competing asset class, and if it pays more, the opportunity cost of holding gold is higher since it doesn’t pay. As a result, the rise in nominal yields has been a headwind for gold over the past year.

Fortunately, the longer-term inflation expectations (in this case, break evens) have been rising as well, and this has kept real yields (nominal less inflation) negative. That has been good for gold, but only marginally. Reason being, it is the change in real yields that matter more so than the absolute level. Gold really likes it when real yields are falling vs stable.

Let’s give real yields a positive for 2021, too, since they remained negative. For 2022, this gets a bit more uncertain.

We believe nominal yields will continue to trend higher in 2022 but do not believe they will accelerate meaningfully. Simultaneously, inflation expectations are likely to rise as well as we are seeing sticky priced items starting to rise, company intentions remain elevated for further price increases and wages ticking higher. Put this all together, and real yields likely stay below zero. But we are going to give this an

X for 2022. This is partly due to the negative starting point, and we could see nominal yields potentially rise faster than longer-term inflation expectations.

U.S. Dollar

– This one is pretty clear: gold is priced in U.S. dollars along with many other currencies and is considered a real asset. So, if the U.S. dollar rises, the quoted price of gold tends to fall. In 2021, the U.S. dollar did rise against most currencies. From a Canadian perspective, you may have missed this, given the strength in the loonie during the same period.

The rising U.S. dollar was a headwind for gold in 2021; that is an

X in our gold influencers table.

As we move into 2022, with central banks expected to pivot at different times and speeds, currency volatility will likely elevate. More major currencies are undervalued vs the U.S. dollar than overvalued, with a number expected to raise rates sooner than the Fed. And while periods of dollar strength are expected in risk-off periods, the longer trend is likely lower. We will give currency a ✓.

Risk-on / Risk-off: So, gold performed somewhat poorly in a year that North American indices rose 25+%. Pretty sure a raging bull run is not when gold shines. It is a safe haven asset, and in a year where investors were chasing outsized returns, gold shouldn’t do well. If your defensive assets went up 15-25% last year, best to check your classifications, as those are likely not really defensive.

2022 has a lot of significant moving parts for the market to digest. The changing pace and, in some cases, direction of monetary and fiscal stimulus will be a big one.

Add in the potential of changing the market leadership that’s currently being debated by the markets, and this year will likely be a bumpier ride. This could lead to some risk-off periods and, given how far markets have advanced over the past twenty months, safe haven assets may be opportune. So, ✓ it is for 2022.

Flows: As with any asset, net inflows tend to help the price and outflows hurt. In this case, our proxy is the changes in gold held by ETFs (chart). Clearly there is a connection here. We could debate whether it is a change in price that drives ETF net flows (classic performance chasing), the flows causing the price change or a combination of the two. This connection has become stronger during the past decade or so.

After strong inflows in 2020, gold experienced gradual outflows in 2021. If you take a step back, this is logical. A ton (not a literal ton) of the inflows in 2020 were driven by the extreme uncertainty created by the pandemic; call it a safe place to park capital. As uncertainty continued to decline and markets rose, the money was re-allocated back to whence it came. It sounds simple, but often things are.

Of course, then there are digital assets (aka bitcoin and friends). Maybe some who dislike the gradual (sometimes a bit faster than gradual) decline of purchasing power of fiat currencies have opted to move from gold to digital assets. But we don’t see that as a big enough component of flows. Besides, gold is a safe haven real asset. Digital assets may be that someday but remain a high risk/reward asset for now.

Flows in 2022 could go either way.

Digital assets may continue to lure some capital out of gold. On the positive, more than half the money that piled into gold as the pandemic fear peaked has been pulled back out. And the pace of outflows has slowed to a trickle in recent months. We will give our outlook for flows as neutral for the coming year.

Investment Implications

Anyone who has invested in gold for more than a few years has likely been frustrated at one point or another. There are many moving parts to gold, and sometimes one factor or influencer matters more than others, and the ones that matter most change with time. So, maybe real yields will be the primary driver this year, maybe the U.S. dollar, or maybe flows. What we do know is more of these influencers are better positioned for a positive lift for gold as we head into 2022.

And let us not forget that owning gold usually provides a safe haven asset. What if we get a risk-off period, which could be driven by slowing growth, the flare-up of a conflict on the Eurasian plain, or any other reason? If the bottlenecks in the supply chain remain, that could see nominal yields fall while inflation doesn’t. The U.S. dollar would rise, offsetting some of the positive impulses for gold, but the net impact would likely be pretty good.

Gold isn’t broken; it behaved as a safe haven asset should in a year that was predominately risk-on.

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used herein under a non-exclusive license by Echelon Wealth Partners Inc. (“Echelon”) for information purposes only. The statements and statistics contained herein are based on material believed to be reliable but there is no guarantee they are accurate or complete. Particular investments or trading strategies should be evaluated relative to each individual's objectives in consultation with their Echelon representative.

Echelon Wealth Partners Ltd.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Ltd. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.