For most Canadian investors, when thinking currency, it is all about the USD/CAD exchange rate. And on this topic, there really hasn’t been much to talk about. The CAD has remained relatively rangebound from 78-81 cents over the past quarters. But what has really been happening is that both the US dollar (USD) and the Canadian loonie (CAD) have been appreciating together, materially.

Both currencies are enjoying the fact that our respective central banks are, on the hawkish spectrum, near the top. 50 bps moves are being implemented and the expectations are for overnight rates to move higher pretty quickly this year. Other central banks are also becoming more hawkish, but not to the same degree.

The USD has also caught a strong bid as a safe-haven currency given heightened geopolitical risks. It is historically a safe-haven currency and enjoys a large physical distance from the war in Ukraine. The CAD is not a safe-haven currency, but we do have the same kind of stuff in the ground as Ukraine and Russia. Given their supply is under great uncertainty, that is positive for the Canadian TSX and the loonie. Stepping outside our North American bubble, measured against the CAD, the euro is down 10% over the past year and yen down 15%. Keep that in mind when looking at rather poor returns on many international holdings—yes, the stock or fund prices are probably down, but the currency is increasing the magnitude of the drop. More on this later.

Side note –

There has been a lot of talk of a commodity super cycle given the obvious rise in commodity prices. Depending on the commodity index of your choice, prices are up near or above the peaks reached at the tail end of the 2002-2008 super cycle (and 2011 echo).

The missing ingredient, in our view, is demand growth. We have seen demand growth following the 2020 recession, but this is similar to the echo of 2011. Now the spike in commodity prices is driven solely by supply issues as demand is starting to slow.

We don’t think that is the environment for a commodity super cycle, even acknowledging the underinvestment in capacity over the past few years.

The Canadian dollar is also not reacting as if this is a commodity super cycle. Plus, how can you reconcile that a commodity super cycle is ahead at the same time there is slowing economic growth, and even talk of recession. It does not compute. Now back to currency.

Where to from here?

Near term –

Fundamentally, we don’t have a near-term high-conviction view on the USD/CAD exchange rate and expect it to remain in the current range. If the demand for a safe-haven currency keeps a bid on the USD, it’s safe bet that’s because the situation continues to look dire between Ukraine and Russia. That keeps the CAD high too.

If a resolution appears, USD falls as demand for a safe haven diminishes and the CAD falls too as uncertainty around the global commodity supply lessens. Plus given the economic data, it’s unlikely that either central bank backs off their tightening path, which has just gotten started.

From a technical perspective (courtesy Derek Benedet), being a high beta FX cross has its benefits, especially when the country is one of the world’s larger commodity producers. We’re in an environment of persistently positive risk sentiment for the Canadian dollar, yet it has failed to achieve what we would characterize as a meaningful technical breakout.

Near-term overhead resistance remains firmly entrenched. The frontline would be the March and January highs around $0.8030, with the next levels of resistance staggered above and below $0.8200. As we write, the CAD/USD rate is roughly in the middle of its year-long rangebound trading action.

Near-term momentum has been improving, with the RSI steadily trending higher and the latest jump higher this week bringing the loonie close to upper resistance level. In doing so, it has also steadily rejected a retest of the falling trendline connecting the highs of June, October, and January. This is a noteworthy positive development. Coinciding with the breakout above the falling trendline was a move above the 200-day moving average. This too has held the retest, and we’re closing in on a likely positive crossover of the 50-day over the 200day moving average. Another positive development.

Near-term momentum has been improving and overhead barriers are being challenged. A breakout above the previous highs this year would be required to confirm a resumption of a new trend. For now, the loonie remains locked in a countertrend consolidation range, which without any clear impetus will likely continue to constrain volatility.

Medium term –

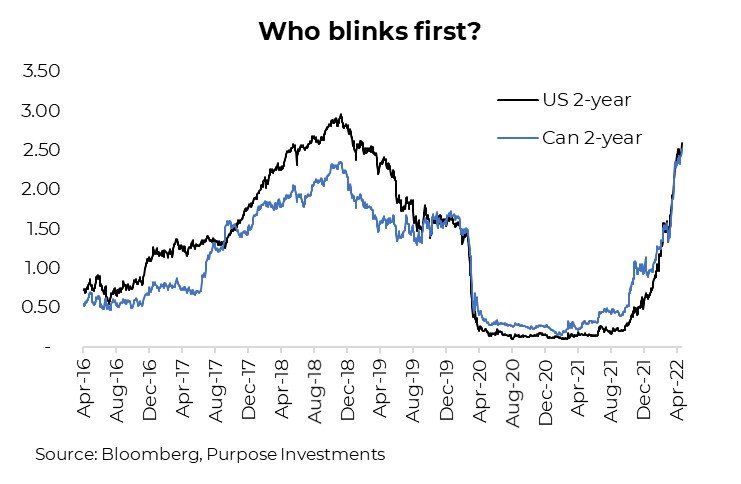

Canada’s economy is more sensitive to higher yields. We are more reliant on housing and our consumers are more indebted compared to the U.S. This may cause the Bank of Canada (BOC) to blink first on relative rate hiking paths. To simplify, we can just look at the 2-year yields between Canadian Government bonds and U.S. Treasuries to capture what the bond market is pricing in for rate hikes (not perfect but close enough). At the moment, both 2 year yields are about equal, or both are pricing in similar paths for there spective central banks. Clearly, very aggressive hiking for both.

Later this year, as growth begins to slow, we believe the Bank of Canada softens its path before the Fed. That is likely a negative for the CAD. Furthermore, periods of slower economic growth also favour USD over CAD. Add to this, the CAD is a bit overvalued currently based on Purchasing Power Parity (PPP).

Investment Implications

From a CAD/USD perspective, we believe range bound is the most likely path over the coming months. However, later this year and into next, we believe the USD has the advantage. This means from an investment perspective, adding to U.S. exposure –or at least not hedging as much— may be prudent. Oh, and if you are wondering about longer term, well nobody can see that far, or at least we know we can’t.

The strong CAD relative to global currencies offers a current opportunity. For those with limited investments outside North America, this may be a good time to consider adding some. Maybe even taking some profit from Canada. The TSX will not fair as well as it has should global growth slow or yields start taking a bite out of Canadian housing.

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for

information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used herein under a non-exclusive license by Echelon Wealth Partners Inc. (“Echelon”) for information purposes only. The statements and statistics contained herein are based on material believed to be reliable but there is no guarantee they are accurate or complete. Particular investments or trading strategies should be evaluated relative to each individual's objectives in consultation with their Echelon representative.

Echelon Wealth Partners Ltd.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Ltd. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.