There is little doubt that at the core of most every Canadian’s portfolio is a healthy allocation to dividend-paying equities. And for many good reasons. Dividends enjoy preferential tax treatment, notably Canadian dividend-paying companies. Bond yields had been declining since the 1980s, enticing more investors to harvest cash flow from equities instead of bonds. The volatility of dividend strategies has been less than the overall market and the returns have been comparable. Cash flow, better taxation, returns, and less risk… that’s like a four of a kind in the investment world. Not to mention, when investors have ventured into growth pockets in the Canadian market, the experience has not been great. With memories of Nortel, Encana, Biovail, Potash, and Research in Motion, there has been enough boom/busts to make any investor return to the warm comfort of their dividend payers.

As managers of a few dividend strategies, we are squarely in the camp that dividend-paying companies should be at the core of most portfolios, whether we are managing them or not. But this isn’t a pompom ethos about dividends, instead we are going to share our views on a risk for dividend strategies – namely rising yields. A good portion of the performance attributes that dividend strategies have delivered for investors over the past decades can be explained by falling bond yields. Many dividend companies are treated as bond proxies or as long duration investments, so when yields fall, their price tends to rise. That has been a tailwind for many years but is starting to become a headwind as yields move higher.

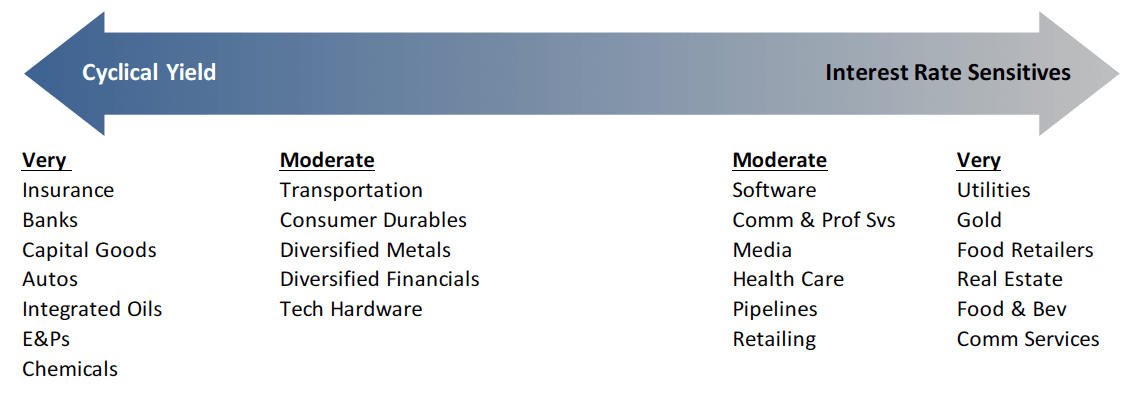

But not all dividend-paying companies have the same sensitivity to changes in bond yields. Some are very sensitive, which we refer to as ‘Interest Rate Sensitives.’ Some are less sensitive to yields – or may actually benefit from rising yields – and we refer to those as ‘Cyclical Yield.’ As the name suggests, Cyclical Yield dividend-payers tend to be in industries that are more economically sensitive. If the economy is doing well, they should do well and bond yields should rise. Conversely, Interest Rate Sensitives are less sensitive to economic activity and react more to yields in the opposite direction.

Based on historical correlations and beta (slope) to changes in bond yields, we sorted dividend-paying sub-industries. This ranking incorporated a 10+ year period and a focus on periods of rising yields (there have not been too many over the past decade). This helps provide a guide for which companies or industries in the Cyclical Yield grouping can better handle rising yields. Conversely, those that would benefit should yields move lower are in the Interest Rate Sensitive group.

If you believe, as we do, that bond yields have embarked on an upward trajectory due to solid economic growth and inflationary pressures, tilting more towards Cyclical Yield would be prudent. Of course, this does come at a risk. Cyclical companies that pay dividends do not do well if the economy slows. Their cyclical nature does make the dividend sustainability a bit more tenuous, while many Interest Rate Sensitives are at less risk from an economic slowdown. A combination from both buckets makes for a better dividend portfolio, with perhaps a tilt towards the Cyclical Yield companies in the current environment.

It really does come down to the future path of bond yields. In the chart below, we tracked the historical performance of the Canadian Cyclical Yield industries vs the Interest Rate Sensitives. The line rises when Cyclical Yields are outperforming and vice versa. This line has a very strong correlation to Canadian 10-year bond yields. It’s worth noting that this trend of outperformance by Cyclical Yield dividend payers started about a year and a half ago, after really underperforming the Interest Rate Sensitive dividend payers for most of the 2010-2020 decade.

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used herein under a non-exclusive license by Echelon Wealth Partners Inc. (“Echelon”) for information purposes only. The statements and statistics contained herein are based on material believed to be reliable but there is no guarantee they are accurate or complete. Particular investments or trading strategies should be evaluated relative to each individual's objectives in consultation with their Echelon representative.

Echelon Wealth Partners Ltd.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Ltd. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.