Listening to the news, a political debate, or overhearing a conversation on the bus

(yes, I ride the bus), the one recurring topic appears to be inflation. This should not be viewed as the wisdom of the crowd as once an economic topic reaches the masses, it is often completely priced into the market or about to start reversing.

Now that isn’t a well-researched cause and effect relationship but the easiest cure for inflation, outside peace in Ukraine, is slower economic activity, which is happening.

There is no denying the global economy is starting to slow. Rate hikes, tightening financial conditions, a strong U.S. dollar, higher energy prices, China growth…the list goes on. This was widely expected by just about everyone. And over the past few weeks the fear from the market’s perspective has clearly shifted from inflation/yields/Fed to the global economy. But this market is pretty manic in how it reacts to news, perhaps because of the preponderance of bad news so far in 2022.

Some good news – inflation fears starting to fade.

Inflation, or price adjustments, are slow moving processes in the economy. An economy that we froze and then thawed, rather abruptly, caused many dislocations. And while inflationary pressures are not ending as the dislocations continue to reverberate through the economy, many of the previous forces are abating.

Look at copper prices—they had been rising for most months this year and have now fallen 12% over the past month. Shortages are also easing.

Much of the inflation was caused by imbalances. Supply too slow to respond (due to Covid) to stronger-than anticipated demand resumption. Shortages and a low inventory to sales in 2020 till near end of 2021 fuelled inflation. Now the ratio is better, supply is catching up as demand is starting to slow for general merchandise. This trend is evident in other categories as well from home furnishings to building supplies. Autos remain the outlier now as supply continues to struggle.

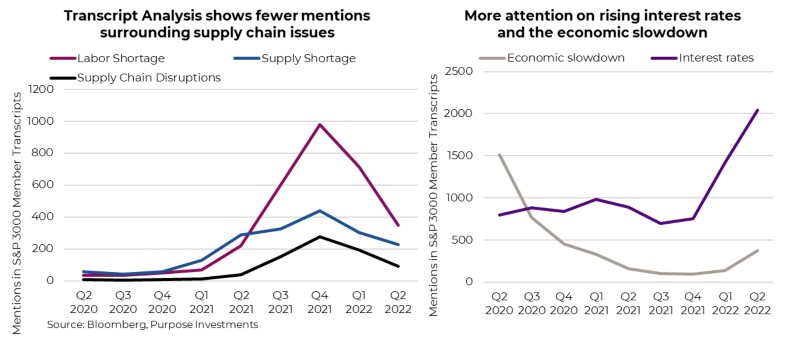

This improving trend is also evident during company earnings calls.

The number of mentions among Russell 3000 companies of labour shortages, supply shortages, and supply chain disruptions has fallen this quarter. While the quarter is not over, about 90% of companies have held an earnings call so far. On the rise though is interest rates, which is a concern.

Inflation isn’t gone, but the upward direction appears to be. Yes, China lockdowns remains a risk for inflation, but the system appears to be getting more resilient. Also worth noting from a content perspective, household durables and apparel have a high China content—these two categories have seen some of the biggest slowing of demand, which should help.

It is difficult to have both slowing growth and inflation rising. As growth slows, the inflationary pressures should ease in the coming months. The bond market has already sniffed this out. 10-year U.S. and Canadian yields, which both reached 3.12% have retreated to below 2.90%. 5-year forward breakevens, a measure of how much inflation is priced into the bond market, have been falling over the past month after rising significantly in March and half of April. And the amount of Fed hikes priced into the futures market has stopped climbing and even ticked a bit lower.

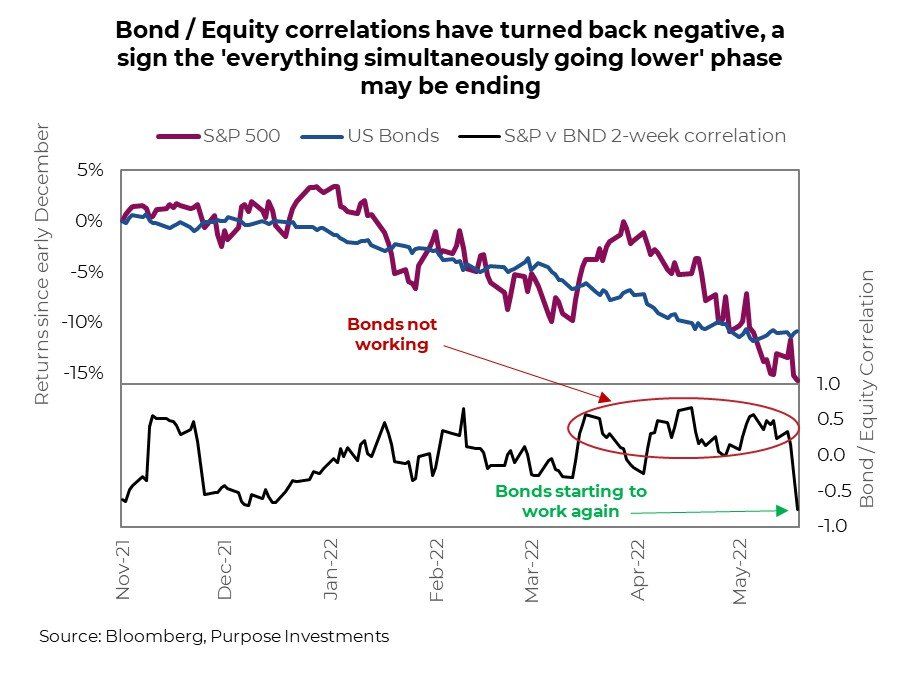

Add all this up, the market is becoming less concerned about inflation. This is good news and has helped bonds once again start to behave as bonds should. That is, during periods of equity weakness, bonds have started to rise in price, providing a stabilizer for portfolios. A much more pleasant behaviour compared with the previous months that saw both equities and bonds falling together.

The following chart shows the performance of the S&P 500 and U.S. bonds since the beginning of December.

What has made this a more painful corrective phase in the market is bonds have been falling with equities.

This can be seen in the lower part of the chart, which is the two-week rolling correlation between equities and bonds. This was around zero or even positive for the past few months. Until recently, as the correction turned strongly negative, a more normal relationship between bonds and equities during periods of equity market weakness. Equity markets moving lower is never a good, but bonds behaving more as a stabilizer is a good encouraging that the price resetting may be nearing an end.

Less inflation is good news for markets but trading that news for rising recession risk is bitter sweet. Admittedly, we did consider, “Out of the Inflationary Frying Pan and into the Recessionary Fire” as the title for this week’s Ethos. But it’s way too early to combine the word “recession” and “fire.”

Yes, the probabilities of a recession have risen but it still remains far from the base case. We went down this road last week and will likely be going down the road again in multiple future editions.

Investment Implications

The cure for inflation has always been slower aggregate demand (that is eco talk for economic growth) and that is starting to materialize. This has already begun relieving inflation fears within the bond market, which likely has a better gauge on the situation than folks talking on the bus or the random interviewee on the news. This could open the door for a broader bounce, assuming the slowing growth talk doesn’t become too loud. Asset price correction (that is where we are now), market reprieve (bounce), and then another correction caused by slowing growth have remained our most likely path for markets this year. Of course, we say this with the cautionary note that markets typically surprise everyone in one direction or another.

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used herein under a non-exclusive license by Echelon Wealth Partners Inc. (“Echelon”) for information purposes only. The statements and statistics contained herein are based on material believed to be reliable but there is no guarantee they are accurate or complete. Particular investments or trading strategies should be evaluated relative to each individual's objectives in consultation with their Echelon representative.

Echelon Wealth Partners Ltd.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Ltd. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.