The U.S. Federal Reserve is about to commence quantitative tightening (QT).

For those not all up to speed on quantitative maneuvers by central banks, QT and quantitative easing (QE) are two tools central banks have used extensively over the past decade or so. To simplify things, QE is when the central bank buys bonds to support the market/economy. Obviously, someone has to sell them these bonds, meaning that the seller then gets some cash in their pocket. Perhaps they buy another Treasury bond, or maybe an investment-grade bond. Once again, the new seller has cash in their jeans. And so it goes. This even trickles all the way down to equities. Essentially, QE injects liquidity into the financial markets, and financial markets really like liquidity.

All things being equal, more buyers of bonds would lift the price higher and thus move the yield lower. This is ideal for a central bank attempting to lift asset

prices to provide stability and encourage economic activity. But things are never equal—more on this later.

The opposite of QE is QT. In this case, the central bank is selling their bonds or allowing them to expire. If selling, another investor needs to have the capital to buy said bond, so they may sell another asset to raise money. This is removing liquidity. Letting a bond mature has the same impact as chances are the government that issued the bond has to refinance and issue a replacement bond, which has to be purchased by someone.

Note to reader: yes, this is oversimplified. QE can be immunized, it can be used to buy other assets, etc. But don’t want to get too far into the weeds of the

mechanics.

QE injects liquidity and QT removes it.

So why are we talking “Q” today?

Well, if you thought the amount of QE following the financial crisis was big, the QE following the pandemic has been epic.

And this certainly contributed to inflating asset prices from bonds, to equities to real estate. And as we are on the cusp of starting QT, the opposite of this is liquidity injection. So will markets tumble and yields rise even more?

If everything else were static, QT would remove liquidity from the financial system. This would cause asset prices to fall, meaning equity and bonds prices would move lower (and bond yields higher). That is perfectly logical. But the markets are not static, and they actually are filled with a healthy portion of smart people. The start of QT is not news—it has been telegraphed and announced multiple times. Which means, dare we say, it’s priced in?

In fact, if you look at past rounds of QE,

it was the announcement that moved markets and bond yields—often weeks or months before the actual commencement of bond purchases. And when those actual bond transactions started, the market had often priced in the pending Fed action and, in most cases, had overreacted (i.e., gone too far).

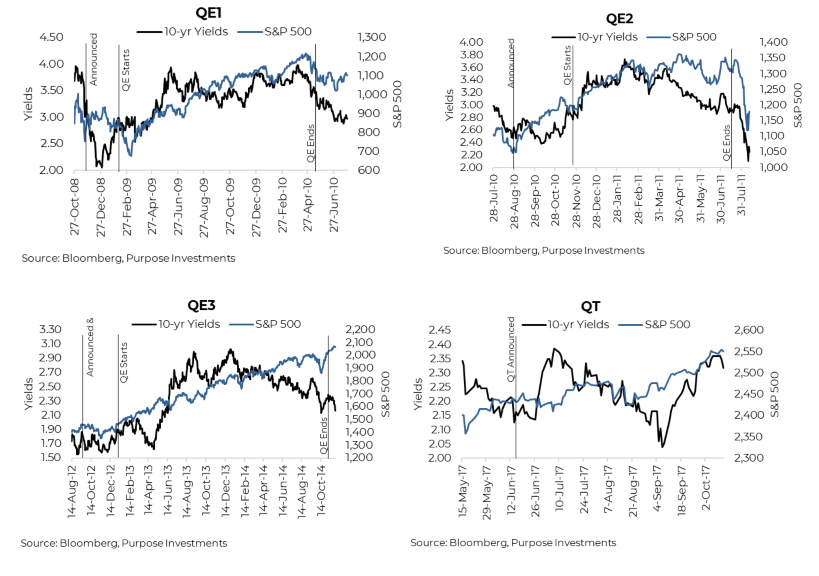

The following charts pack a lot of information. Each one has the 10-year Treasury yield and S&P 500 during various QE programs. For QE1, 2 & 3, there is a vertical line when the announcement was made, a line when the actual QE commenced, and a line when it ended.

To varying degrees, bond yields tended to react lower to the announcement and then rise when the bond buying actually started. In each case, bond yields moved higher during QE, the opposite of what one would expect. Meanwhile,

the equity market loves QE and rises during these periods.

The QT chart for 2017 shows a limited reaction in yields and the market. This is encouraging.

The Covid QE chart at the bottom is a bit more complicated. The S&P 500 clearly rose on QE and peaked around the announcement of a pending QT. Interesting. However, there was still bond buying occurring, just at a declining pace as QT is just about getting started now. Still, it does appear that the announcement carried the punch and perhaps the actual quantitative tightening won’t have much impact.

Investment Implications

We are obviously in uncharted waters from the perspective of monetary policy and influence in the market. And while we all love to draw neat conclusions, such as QE lifts markets and QT hurts markets, there are always other factors at work. Change in economic momentum, investor risk appetite, valuations…the list is long and ever changing. Markets are lower this year for a host of reasons from inflation, war, slowing economic growth, and clearly the QT announcement. Hard conclusions in the investment world are hard to come by.

That being said, based on historical market reactions to QE & QT, we would not be overly concerned about the onset of QT. It was the announcement months back that was the bigger deal. And it is possible the bond and equity market may have already overreacted.

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used herein under a non-exclusive license by Echelon Wealth Partners Inc. (“Echelon”) for information purposes only. The statements and statistics contained herein are based on material believed to be reliable but there is no guarantee they are accurate or complete. Particular investments or trading strategies should be evaluated relative to each individual's objectives in consultation with their Echelon representative.

Echelon Wealth Partners Ltd.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Ltd. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.