2022 is not a fun year to be an investor, an advisor, and –

most definitively from personal experience

–

not a portfolio manager. Inflation remains the market’s biggest angst, there is a potential recession of sorts on the horizon, and it is already well into a bear market. We can and have shared our thoughts on when it could end. Below are our two scenarios; you can choose which one you like, think of it like a ‘choose your own adventure’ book:

Base case (our most likely): Often, when the root cause of a bear market begins to improve, the bear market ends. That means inflation has to start improving, which may be getting close. The October data (out Nov 10) for the US has a number of base effects that should bring down the headline number…or not. It is clearly stickier than most thought, including ourselves. This could mark the end of the bear even without a capitulation event and even with a potential recession on the horizon. Depending on the tenor of the economic slowdown, this would alleviate inflation pressures – so one negative and one positive, which is bigger, is the tough question.

A rollover in US inflation coinciding with a seasonally strong period for markets, given everyone is bearish, makes a Santa Claus rally a distinct possibility.

Other case: Something could break in the meantime. There are a lot of stresses in the market due to the rapid rise in rates & yields. Add to this high food and energy prices while the US dollar rose materially and quickly. This is putting pressure on many economies and many financial mechanisms. The UK had a bit of a wobble, and so did one large international bank. Are there emerging markets near the breaking point due to dollar strength and food/energy costs? So far, markets remain orderly, but there are stresses that could trigger an event. That would likely be the bottom.

Of course, the market’s path is often the one that surprises the most participants, so lots of other potential scenarios do exist. Maybe the potential recession doesn’t happen, or it is not as mild as everyone hopes. Maybe the war will end.

Uncertainty is elevated, and markets don’t mind bad news as much as they despise uncertainty. One good aspect is most of the scenarios, news, and mood are bad. So sentiment is rather negative, which is often good. And don’t forget this bear is ten months old and has already reset a lot of prices – what a year.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used herein under a non- exclusive license by Echelon Wealth Partners Inc. (“Echelon”) for information purposes only. The statements and statistics contained herein are based on material believed to be reliable but there is no guarantee they are accurate or complete. Particular investments or trading strategies should be evaluated relative to each individual's objectives in consultation with their Echelon representative.

Say goodbye to previous leaders

Every bear market is different, and every bull market is different too. It is getting safer to say that this bear market is a cycle-ender. Inflation, potential recession, and bear market check the boxes indicating the bull cycle that started in 2009 has likely ended. Yes, there were previous slowdowns during the decade+ long bull, and

2020 was a technical bear market/recession, but it was such an event followed by stimulus, which was not the end.

This one does appear to be reshuffling excesses, a process that occurs when a cycle ends. The excesses may have been in speculative investments such as cryptocurrencies or profitless technology. Perhaps the biggest excess that has been adjusted is the bond bubble, given how low yields had become. Correcting the excesses is painful and takes time, but it is a natural occurrence that does set the stage for the next bull cycle.

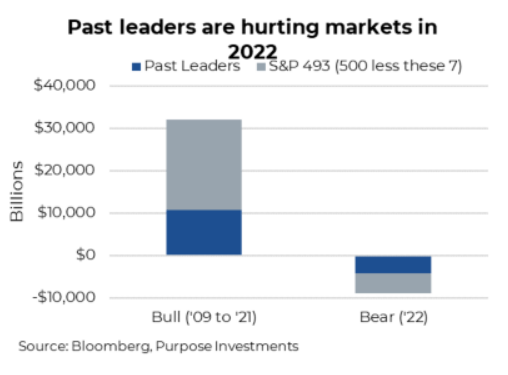

Adding further support that one of the longest bulls has ended is that leadership change appears to be afoot. There is no questioning what led the last equity market bull cycle. It was the FANGMAN stocks – Facebook (now Meta), Apple, Netflix, Google (now Alphabet), Microsoft, Amazon, and Nvidia. This is the expanded version of the original FANG stocks. From 2009 to the peak of the bull cycle, the S&P 500 rose from about $10 to $42 trillion. It was one helluva run.

These seven stocks represented 33% of ALL the gains.

Now the market (S&P 500) has

fallen from $42 to $33.4 trillion, and these seven names are responsible for about 50% of that decline. The biggest gainers are falling the most, which is a common occurrence at the end of a cycle. Now, this doesn’t mean Microsoft or Amazon are doomed, but these previous leaders are weighing heavily on the index during the bear and likely when the next bull begins.

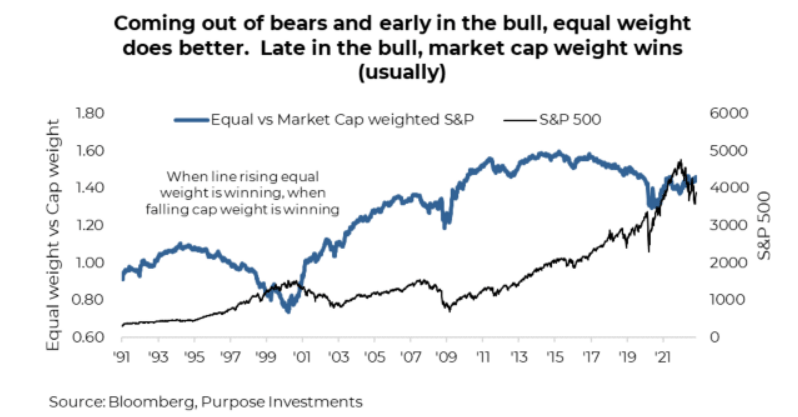

This is a hurdle for market capitalization-weighted indices (most common among indices that weight companies based on their market value). If leadership is going to change, the

previous heavyweights hurt the index more as they decline. And if new leadership rises, it may take years before they reach a big enough weight in the index to move the needle. More reason to lean smaller or equal weight in today’s market. Year to date, the S&P 500 is down -17.4%, while the S&P equal weight is down -12.9%.

If you agree that the FANGMAN are not going to lead the next cycle, then who will? They are still great companies, but

Amazon, for example, went from $58 billion to almost $2 trillion.

Can’t do that twice. The leaders of the last cycle could easily see their share prices rally, given how oversold many have become. But they are unlikely to lead in the next one.

If you want further evidence that the previous winners don’t repeat, we dove into some historical bull runs. This is more industry-focused, given the names would not resonate. As you can see, the top industries in the bull don’t repeat in the five years following a bull run. There is one exception, Agriculture in the 1930s. And when we have some time, we will investigate what was in the Chips industry in the 1930s. Could it have been actual chips? Certainly not the same as Chips in the 90s.

We don’t know who the next leaders will be but will share some thoughts in our upcoming ‘Preparing for the next Bull’ reports expected in late November (if you receive Ethos, you will receive this upcoming report as well). We can say with a good degree of confidence it won’t be the past leaders.

We continue to believe leaning smaller on the capitalization scale makes sense in this environment, whether that is going all the way to small-cap or going more equal weight in the large-cap world. And while we could see some tradeable rallies in the previous stars of the market, we remain cautious of adopting a buy-and-hope strategy among these names.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only. This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional

advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.