Not your typical year, not your typical market

The holiday season offers a good opportunity to pause, take a step back from the daily market gyrations and reflect. While 2021 certainly had a lot of twists and turns from a pandemic that won’t go away, to inflation, to meme stocks, it ended up being a rather pleasant year for investors with many equity indices advancing over 20%. We will save a deeper dive into market performance till later, but for now let’s hit a few of the highlights of 2021:

Persistent Pandemic

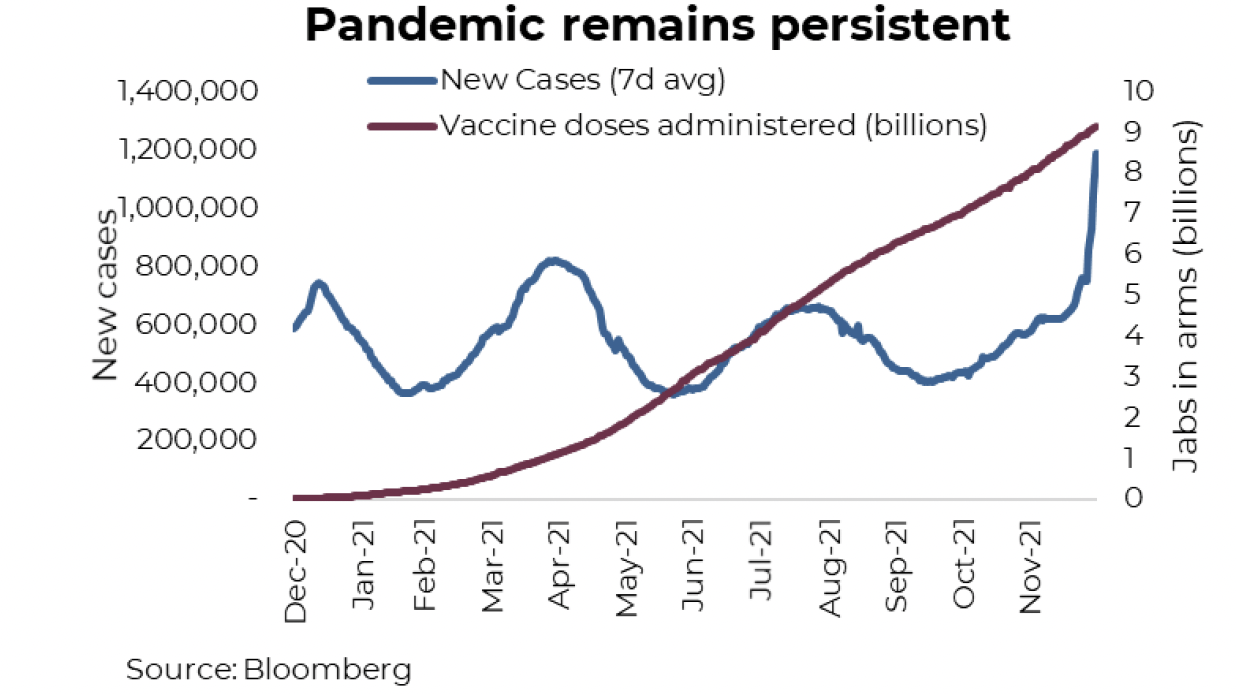

As 2021 started, the race to develop, gain approval and rollout vaccines was really starting to get going. Thanks to a global effort by governments, health care companies and advances in science, vaccines which historically have taken a decade to develop were completed in less than a year. Mass production has resulted in over 9 billion jabs administered during the year. Truly impressive.

Now if you had told anyone a year ago 9 billion vaccines would be distributed, most would have expected the daily case counts to be lower today. The Omicron variant is now driving new records for cases, combined with much broader testing. So far the evidence does support vaccines limit the spread and even more importantly, dramatically reduce hospitalization rates. Nonetheless, the world thought we would be in a better place by now. This pandemic has truly proven to be more persistent, with some starting to use the word ‘endemic’.

Society has adapted and continues to learn how to live with the disease. While approaches vary considerably from region to region, it is testament of people’s resilience and adaptability.

Digital Domination

Very often the words ‘New Normal’ are bantered about in an attempt to describe what life will be like, even after the pandemic fades. However, the pandemic may be more akin to hitting the fast forward button on a number of pre-existing trends. Remote work, diminishing bricks & mortar retail, the cloud, AI, the list goes on. 2021 saw a dramatic increase in the speed of these trends, in many cases out of necessity.

This drove demand for hardware, connectivity, nicer home office chairs and of course an improved background for those abundant zoom calls. Conferences, education, meetings all moved to a virtual world. Documents are now signed digitally. And of course shopping went more and more online.

While there were many losers, or companies that suffered from the acceleration of many key trends, there were some big winners too. The good news for the equity markets, the winners tended to have a much bigger weight compared to the losers - advantage market cap weighted indices.

Supply Chains & Inflation

Netflix was able to meet the rising demand of changing consumer habits caused by the pandemic, more subscribers the merrier. The same cannot be said for producers of goods. As spending habits changed, from dinner out to home improvements, supply chains simply couldn’t adjust quickly enough. Adding to the complexity of supply chain logistics was pockets of disruptions caused by Covid outbreaks and a previous mantra of ‘just in time logistics’.

The interconnectivity and dependence of supply chains become very apparent. While grossly simplifying, a good example is less wind in Europe led to more gas demand as weather cooled, but supply couldn’t respond quickly enough leading to higher prices, this resulted in fertilizer production being taken offline (nat gas being a key input), this drove all fertilizer prices higher globally which is driving higher agriculture prices. Yes, your Cheerios may cost more because of calm winds in Europe.

Changing spending habits, bottlenecks, disruptions and high energy prices have driven consumer prices higher. While this will ease as the supply side re-adjusts to meet demand, and CPI data will come back down, the question is whether the longer term seeds of inflation are planted and starting to grow? We believe periods of elevated inflation are likely to be a recurring theme in the years ahead, but likely much lower than CPI data is printing today.

Sustainability

Weather deserves mention in any look back on 2021. Wildfires, floods, heat domes, atmospheric rivers, one would have to assume a polar vortex is next. There is no denying sustainability gained a lot of attention and traction in 2021, highlighted even more by the COP26 gathering.

This has led to increased focus on sustainability, including from the investment world. Key funds have increasingly announced the desire to stop investing in fossil fuel related companies. Meanwhile most companies continue to improve their respective carbon footprints, even companies in the extraction world.

Labour Mobility

2021 may go down as the ‘great resignation’ year. On the surface one would assume with many people working remotely, switching employers would be a more challenging endeavor. It is not easy to make new friends and connections via zoom as compared to sitting in the office, within the corporate ether. Still, lifestyle choices, increased demand for labour, inflated stock & home prices, and perhaps even just working from home pondering ‘what is next’, has led to record paces of quitting.

It may actually be more labour freedom from geography. While anecdotal, in a conversation with an advisor team in our Partnership Program, they highlighted this year has seen a much higher proportion of new clients from cities outside their home turf. Geography isn’t the barrier it used to be as meetings are now virtual, documents are signed digitally. In a very cool chart from McKinsey & Company, a survey of people who started a new job in a different city, only 13% were required to move to the new city.

2021 does appear to be a year that labour has enjoyed more flexibility and negotiating power. This has led to substantial changes in how, where and when people are working. Question is will it begin showing up more and more in wages.

So How About Those Markets

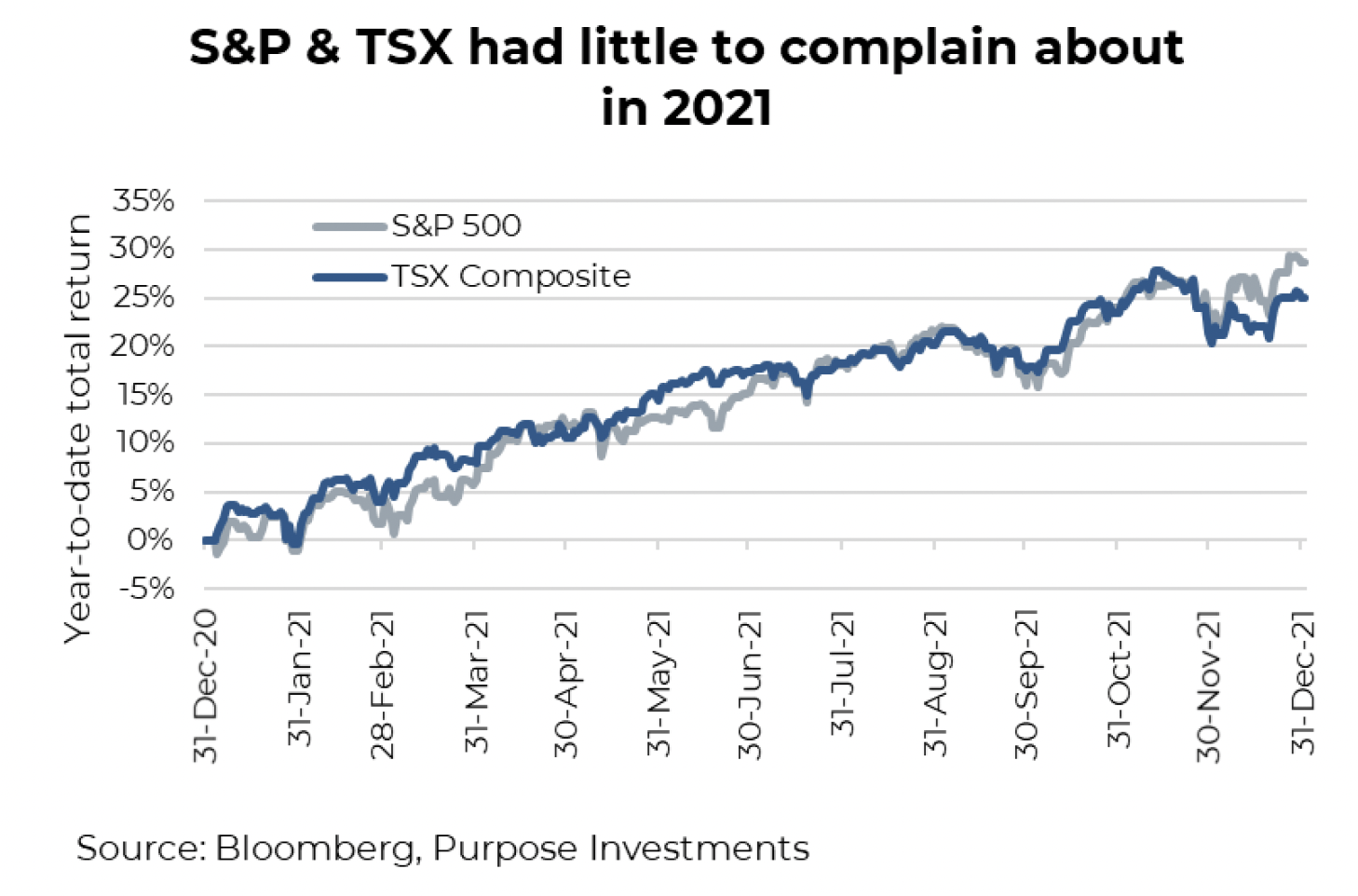

2021 is likely going to be one of those years that investors make a healthy return, let’s say 8-12%, yet they feel like it should have been more. The pain of the bear market of Q1 2020 appears to have left most investors memory and has been replaced by the barrage of headlines highlighting record highs for the S&P 500 and the TSX. The S&P 500 has now made a brand new all-time high in 14 consecutive months, rising 28.7% in 2021. TSX doesn’t have the same string of records, but +25.1% for any calendar year is impressive.

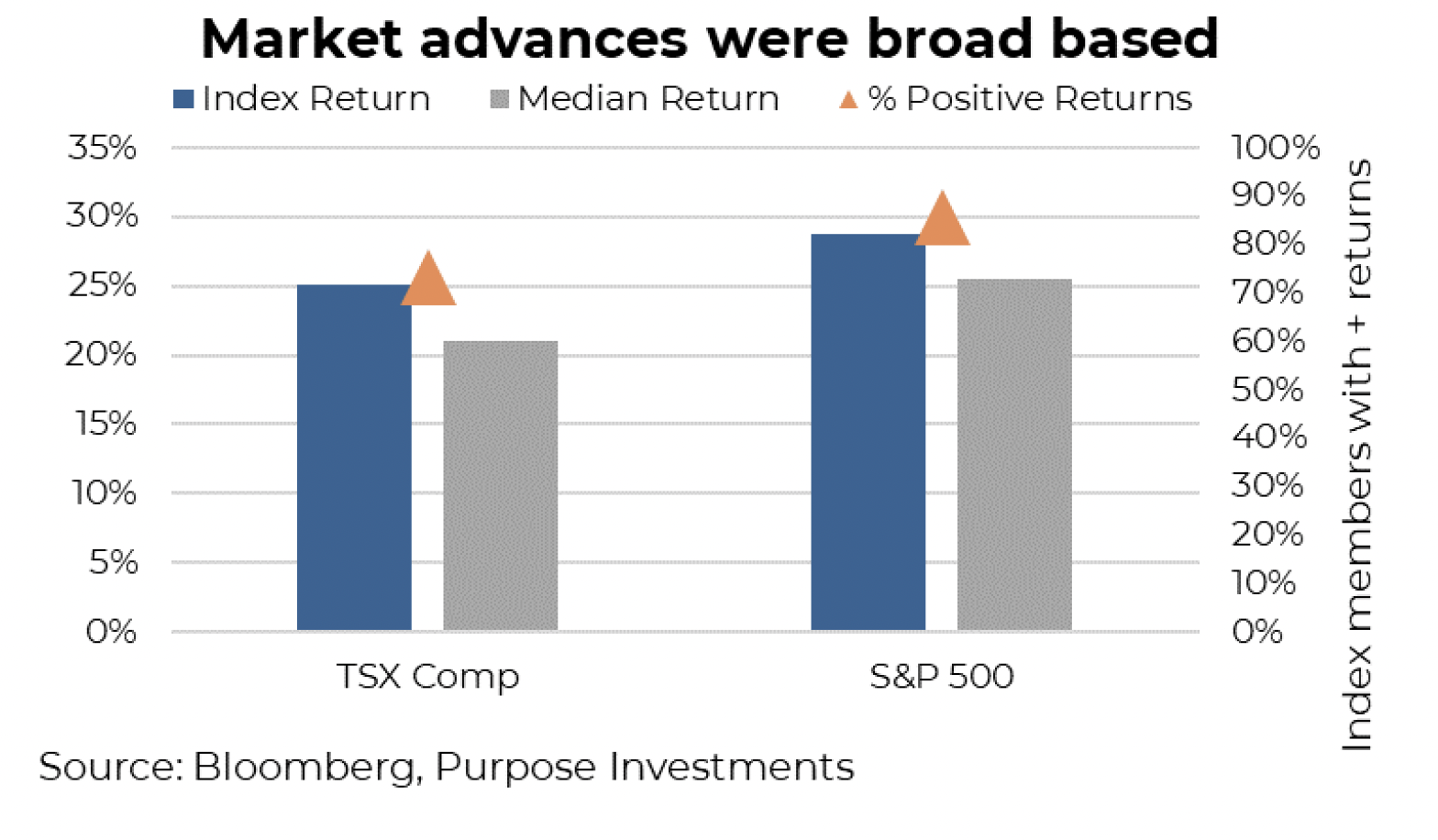

There is no denying the TSX and S&P 500 had great years. The news keeps getting better as it wasn’t just the megacaps. Microsoft, Apple. Shopify and Royal Bank, given their weights and solid performance did some heavy index lifting. But the gains were broad based with the median index member returns relatively close to the overall market. This can also be seen in the equal performance of the S&P 500 and S&P 500 equal weight index. Plus very few companies lost money. Only about 14% of the S&P 500 members declined on the year, while 26% of TSX members fell (skewed a bit higher by more gold and marijuana companies which comprised about ½ of all the companies that declined).

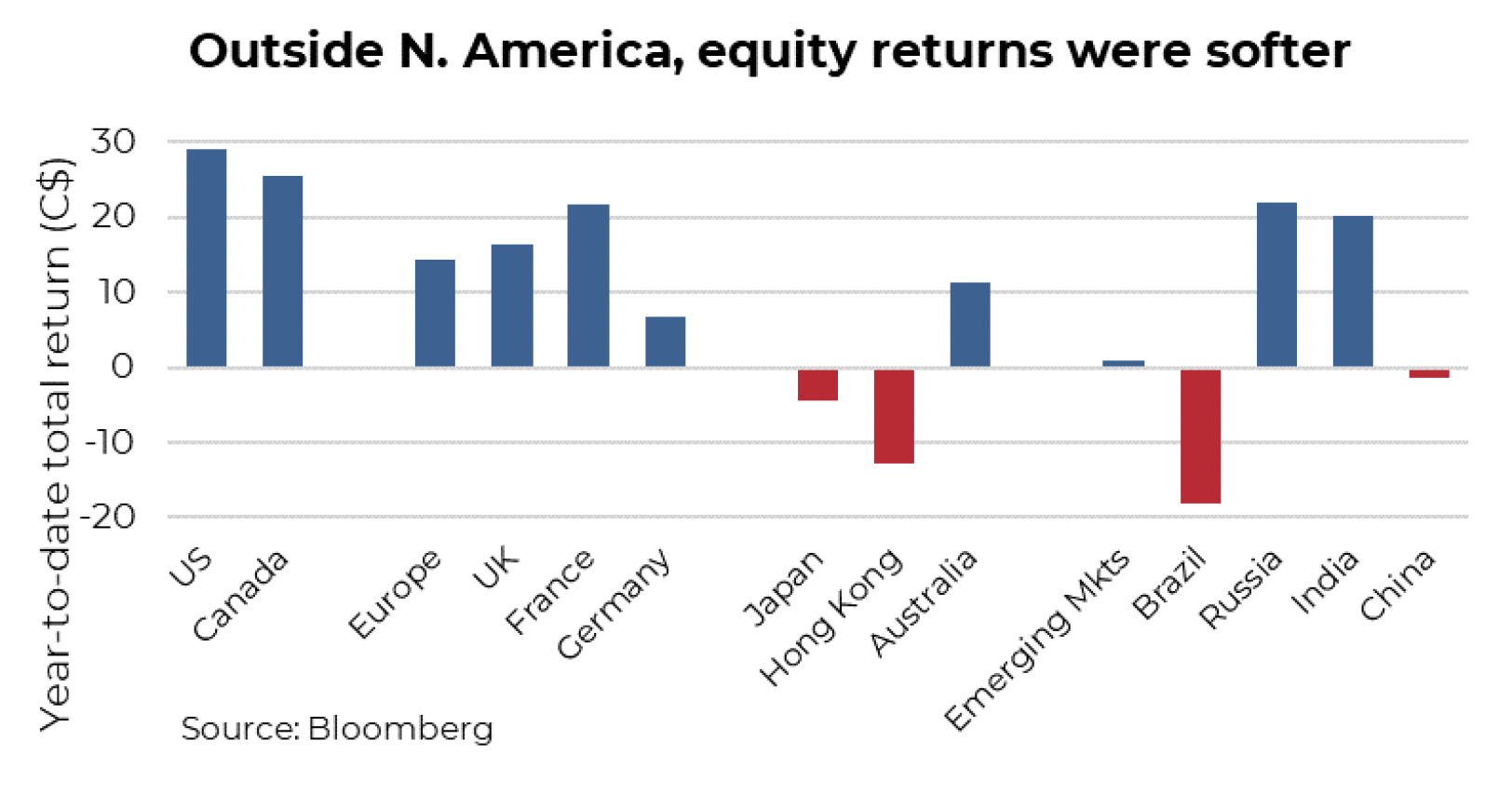

Geographic equity diversification hurt performance in 2021

If you only owned Canadian and U.S. equities, you are likely feeling especially good about 2021. However, most of us have diversified portfolios because not all years are like 2021. That being said,

diversification, either by geography or by asset class, detracted from performance this past year.

Other major equity indices did not keep pace with North American markets, especially once converted back into Canadian dollars. Europe did ok a bit over 10%, Asia much worse and emerging markets were all over the place. Still, equity returns were largely positive and in many cases positive in a material fashion.

You know what grew even faster than equity markets in 2021? Earnings!! Companies pivoted and adjusted very quickly to pandemic induced changes in behaviour. Combined with unprecedented monetary and fiscal stimulus, driving the global economy first to recover then to start reaching new highs, earnings growth spiked higher. Even when ‘P’ rises, if ‘E’ rises faster, you get better valuations. This was the case in most equity markets.

Asset allocation diversification muted returns

Outside of equities, returns were even harder to come by. With global yields rising during the year, bonds had a tougher go and in most cases lost value during the year. Truth be told, these results would have been worse had Omicron not surfaced to push global yields back down late in the year. Credit performed well, although this performance was front end loaded as the economy gained traction and fear of bankruptcies faded.

Put it all together

2021 was a very eventful year, lots of news, great economic growth and thankfully markets that reacted well. A generalized balanced portfolio likely come through the year ranging between 8-12% depending on investment mixes. Yes, the defensive positions likely dragged down performance, but that is literally what they are designed to do - act as a ballast for the overall portfolio in good times not just bad times. Overall, hard to complain about 2021 from a portfolio perspective.

Human nature may have investors desiring to tilt portfolios to take on more risk. While we do remain bullish for 2022 [Purpose 2022 Outlook: The long road back to the new normal], it would appear some of the future performance may have already been enjoyed by the markets. And this coming year will likely prove more challenging given central bank pivots, continued inflation issues and the slowing pace of growth. We would suggest expelling defensive components of your portfolio to chase upside may prove inopportune as we head into 2022.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Greg Taylor and Derek Benedet Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used herein under a non-exclusive license by Echelon Wealth Partners Inc. (“Echelon”) for information purposes only. The statements and statistics contained herein are based on material believed to be reliable but there is no guarantee they are accurate or complete. Particular investments or trading strategies should be evaluated relative to each individual's objectives in consultation with their Echelon representative.

Echelon Wealth Partners Ltd.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Ltd. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.