When big news happens, markets move. And this year there has been no shortage of big news from the pandemic loosening its hold, yields rising, inflation spiking, central banks pivoting and, the biggest news, Russian invading Ukraine.

This terrible senseless conflict has the West and Russia one step removed from direct conflict. The sanctions imposed on Russia are unprecedented in the level and never before has this level of sanctions been imposed on such a globally integrated nation. Markets have reacted to this, pushing global equities into the first correction (down 10%) since the onset of the pandemic. Commodities prices have exploded higher from oil to wheat. Markets most near or integrated with the conflict region have been hit the hardest while markets with lots of resources and greater distance to the conflict zone, like the Toronto Stock Exchange (TSX), have risen. It may be lost on many, but the TSX is +4% while European markets are down -4% since the invasion started.

We say best of luck to anyone attempting to forecast the path of this conflict. Even more challenging is how markets will react to the ebb and flow of news in the short term. When the markets are more vulnerable, they tend to overreact to both good and bad news. This overreaction creates opportunity, especially if you can get your head out of the prevailing news headlines, reflect on current prices and the more probably outcomings over the coming months or quarters. Thinking two or three moves ahead, beyond the short-term market reactions, deserve consideration from a portfolio construction/exposure perspective.

For instance, most have probably come across one of those graphs that shows markets leading up to and following several key conflict events over the past decades (ours is above). This ranges from Crimea, Iraq, Gulf War, 9/11, etc. The typical path for markets is weakness up to and including the event, but six months later markets are most often higher or back to normal. This doesn’t mean the conflict ended—more often the market just became comfortable with the added uncertainty. Let’s go past knee-jerk reactions.

The spike in commodity prices has been a tailwind of Santa-Ana-magnitude for the TSX.

This is clearly a good news story but what about three, six or 12 months from now. We don’t know where oil prices will be sitting. Obviously sanctions and other factors have thrown a monkey wrench into how oil flows around the world, which has resulted in prices rising 20% to 40% from previous levels. Great for the TSX, bad for global economy.

Will oil prices find a new home in the $110-120 range? Will they keep rising to $150 or $200? Or will the oil find its way to markets causing prices to come back down? Nobody knows, but the longer oil stays up here, the greater the risk of a recession.

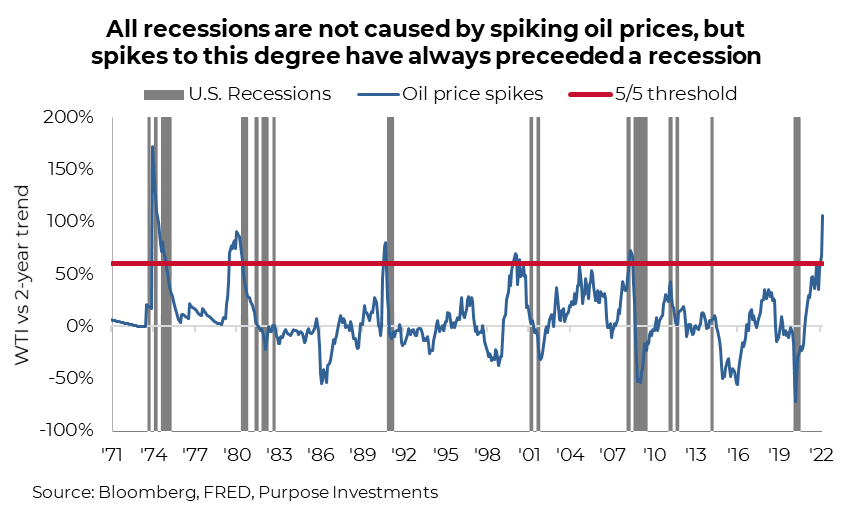

It is safe to say not all recessions are necessarily caused by a spike in oil prices but every time we have seen a spike of the current magnitude, there has been a recession that follows. One could argue this time is different given the strong economic momentum. The global economy is expanding at a very healthy pace today, implying a recession is far from the minds of most forecasters. Energy prices are a tax on consumers and the longer oil prices remains at these elevated levels there is a risk that the economy will slow faster than forecast.

And what does the conflict, sanctions, high commodity prices and uncertainty mean for corporate earnings? While the TSX has benefitted in aggregate, the dispersion of performance is very high. Some companies— those in the commodity space—are up considerably. Many others are down considerably.

The next earnings season is going to be challenging. You can be sure global companies with operations in or near Russia will be taking charges. Meanwhile, cost inflation is likely going to rise, putting pressure on margins.

The good news is the size of the earnings impairments will likely be small on a global scale. Global economic growth, forecast at 4.0% for 2022, is unlikely to be materially impaired by sanctions and the resulting sudden recession in Russia. That nation has less than a 2% weight in the global economy, which brings us to a positive aspect, given valuations have come in considerably.

The U.S. equity market is still expensive by historical standards, but not nearly as much as a few months ago. Meanwhile, the TSX now enjoys valuations below its 20 year median.

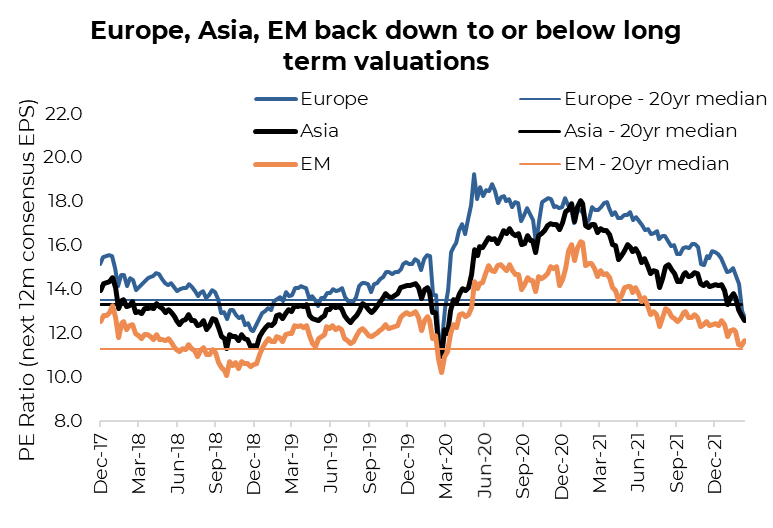

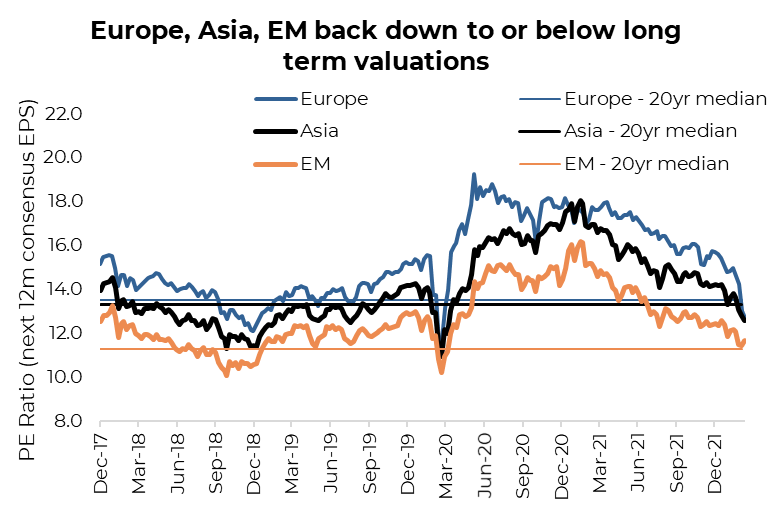

But if you are a value-oriented investor, you have to be interested in global equities. Europe at 12.7x consensus earnings for the next year is cheap. Even if those earnings are reduced a bit in the coming months, there is a heightened level of safety thanks to falling prices. Asia too.

Investment Implications

How does the market chessboard look in three or six months? The conflict could very well be resolved, one way or another, or the market may not care as much. Will the spike in commodity prices, driven by supply-side disruptions persist? A commodity super cycle usually requires a persistent rise in demand, which doesn’t jive with slowing economic growth. Hopefully you had a decent resource weighting heading into this. If so, taking some profits and redeploying to areas such as European or Asian equities given sizeable valuation discounts may be prudent.

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used herein under a non-exclusive license by Echelon Wealth Partners Inc. (“Echelon”) for information purposes only. The statements and statistics contained herein are based on material believed to be reliable but there is no guarantee they are accurate or complete. Particular investments or trading strategies should be evaluated relative to each individual's objectives in consultation with their Echelon representative.

Echelon Wealth Partners Ltd.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Ltd. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.