The often-cited investment adage that stocks go up in the long run sees to apply just about everywhere except Japan. The Nikkei index is still below its peak in 1989, over 30 years ago. Plus, many of the attempted reforms, ranging from monetary, fiscal, and governance, have fallen short and disappointed equity investors. Perhaps this contributed to the creation of yokocho drinking alleys, helping investors drown their sorrows (a must visit for any trip to Tokyo). Despite this sorted historical performance, we have recently become increasingly positive on this subcategory of global equities.

There is no denying the Japanese yen has been crushed. The Bank of Japan (BOJ) is the last major central bank still in the dovish camp while by any measure the rest have become hawkish. At the extreme end of the dovish/hawkish spectrum are the Bank of Canada (BOC) and the U.S. Federal Reserve (Fed). Based on market expectations and pricing, both are on a path to raise rates many more times this year in efforts to combat inflation. While inflation in Japan has picked up, after decades of fighting deflation and stronger demographic headwinds, they have opted to remain dovish. No surprise, this has been very negative for the yen and very positive for the CAD and USD.

The above chart is more pronounced against the USD, and less against many other currencies but a similar trend – weaker yen. We often view developed market currencies as a zero-sum game in the long term but there can be opportunities or headwinds.

With the yen being down so much against the loonie, we believe there is an opportunity from a few perspectives.

At the moment, the BOJ is at one end of the dovish/hawkish spectrum with the BOC and the Fed at the other. However, with inflation starting to crack and economic growth slowing quickly, we believe this spread will narrow. Maybe the BOJ will become a little less dovish and/or the other banks will become less hawkish. Any combination would lead to a rebound in the yen/CAD, which is positive for unhedged exposure to Japan.

It is not just currency though. Most Asian economies have remained on stricter lockdown protocols, given less efficacy/penetration of vaccines plus a much higher population density. And while we have long given up trying to guess the path of this pandemic, it appears that many Asian countries are loosening restrictions. When North America and Europe “opened up,” there was a material boost to economic activity. In 2021, the U.S. economy grew by 5.7%, Canada by 4.6%, and Europe by 5.2%. Asia has some catching up to do with the reopening boost.

But, many nations in Asia are in the emerging market category, which we do not have a positive investment view on (take a look at last week’s Market Insights). Yes, we are positive on the Asian economies and less enthusiastic on the equity markets. Enter Japan.

As a developed economy, it would benefit from the reopening economic boost of the region while being less at risk from the emerging market headwinds.

There is no denying the trend in global economic growth is in the softening direction. However, this trend is softer in Asia and several countries are seeing economic forecasts tick higher. The Japanese equity market enjoys about 50% of sales that come from international trade and operations. In other words, it is even more international than the S&P 500. Now these companies are even more competitive given the lower yen.

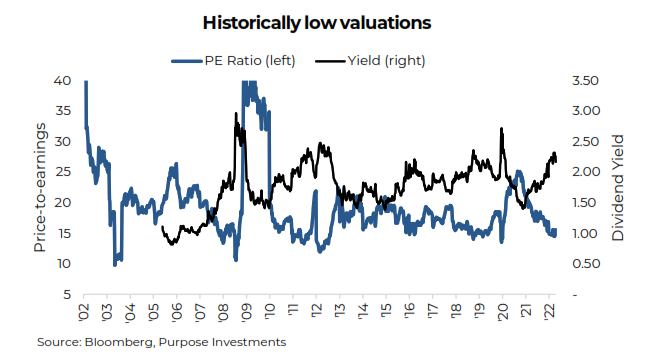

Finally, valuations are certainly attractive. Most metrics, including price-to- earnings are at or near multi-decade trough levels. Even the yield is improving as more companies have been increasing cash flow back to investor via dividends and share buybacks.

Investment Implications

For Canadian investors, the yen is on sale, the Japanese equity market is on the cheap side, and the region appears to be better poised for growth than most others.

These are the positives, but there are negatives as well. The Covid lockdowns could tighten, China certainly has a property issue at the moment that could spill over, and the BOJ could misstep. That being said, the risk/reward appears attractive at this point. We like Japan and yokochos.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional

advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.