The surest path for growing a small fund or ETF into a large fund or ETF is to have great performance. The simple fact is every investor has one core primary goal: to grow their existing money into a larger amount of money. Of course, the magnitude of this goal and the tolerance for the ride along the way varies from one investor to another, but in the end, everyone wants more than they have today. Otherwise, why invest? Performance matters and the report card of an investment is really how it performed. Did it perform well for an A+ or did it perform poorly with a D-. Or if you prefer, a five-star ranking system.

Unfortunately, one question that is not asked often enough is WHY did an investment perform well? Generally, investors are focused more on the result— the performance report card if you prefer. Does solid performance that results in an A+ or 5-star ranking really imply a great process, great insights or superior management? Maybe, in some instances. But more often it is simply that a given strategy had a healthy exposure to a trend that took off in the marketplace.

Sometimes these trends are short-term and can lead to impressive gains. This instance can often be found in some of those thematic ETFs/Funds. The managers / product creators are clearly onto something here. Who cares about diversification? Create a strategy focused on a very narrow theme: if it hits it becomes a home run and the money flows. And for investors, it allows some direct exposure to a theme. Hopefully in a measured exposure as they can get a little bubbly.

Sometimes these trends are super LONG term, which is our topic today. Perhaps one of the biggest mega trends for investors has been the long decline in yields since 1980 and subdued inflation (chart 1).

Recently we have seen an uptick in bond yields, but the move has really been off the pandemic-induced lows. 10-year yields are about back to where they were before the pandemic. The big question is: where to from here? Inflation has moved up as well but so far, the bond market is viewing this as a temporary blip caused by the structural adjustments of the pandemic and re-opening process. We say this based on the very muted reaction in bond yields to the recent upward move in inflation data.

In fact, yields have been kind of ignoring changes to inflation for much of the past decade, and rightfully so. The bond markets behaviour (that is the behaviour of participants) changes over time. In the 1980s when inflation was high and starting to fall, the bond market didn’t buy it and lagged the declining inflation. There was fear that inflation was going to come roaring back. In the 1990s and early 2000s, the bond market tended to move ahead of inflationary data (chart 2). But as the 2000s rolled on, any uptick of inflation quickly faded. Recall all the heat central bankers received for not being able to get inflation over 2%? The bond markets learned response, which persists today, is inflation will prove fleeting. You can really see this in the correlation between inflation and yields over time. This is historically a positive relationship but during the past decade this relationship faded (chart 3). It is now starting to return to normal.

Imagine there’s rising yields, it’s easy if you try

If yields truly bottomed in March of 2020 and are set to rise with inflation in the 2020s this has far reaching implications. Obviously, this will impact bonds, of which investors have had a little taste of negative returns in Q1 of this year. But what if longer yields are going to 3, 4 or 5%? This would have varying impacts on everything from bonds, to equities, to commodities, to real estate, to the economy. Would your home be what it is worth today if yields were

5%? Would your portfolio?

Even if you don’t believe bond yields will rise that much, it is a portfolio risk that is higher today than in years past. Magnifying this portfolio risk is after decades of falling yields, many of the best performing strategies (with hefty allocations in many portfolios) have ridden that long-term mega trend. So if the direction changes, many of these strategies have a problem as do portfolios with an outsized weight in these strategies.

A common and widespread example is that most Canadians love their dividend strategies (chart 4). Ok, maybe love is too strong. And yet this strategy will suffer if yields continue to rise. Or consider that higher duration stocks, like those growth names that have delivered so much A+ performance over the past few years, will suffer. Higher yields essentially make future dollars worth less today. This is not good for growth names that have more of their expected earnings years down the road.

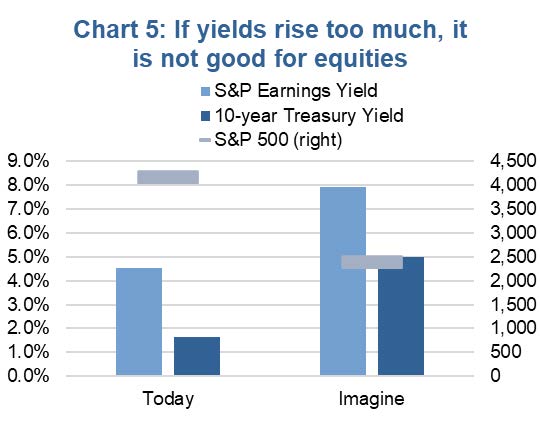

Today the 10-year Treasury yields is 1.65% and the S&P 500 earnings yield (inverse of PE) is 4.65%. Treasury distributions are guaranteed but they won’t grow either. S&P earnings are volatility but can grow. All in, you are receiving an extra 3% for owning equities over Treasuries (comparing yield to earnings yield). So, what if Treasuries yielded 5%? If you still need an extra 3% to own equities, the earnings yield would need to be 8%. Based on today’s record high earnings, that would be about a 40% decline in the price of the S&P 500 (chart 5). Don’t take this literally as there would be offsetting factors such as potentially higher earnings growth, changing market multiple, etc. But higher yields would weigh on equities.

Investment Implications - Imagine

We are not saying longer term yields will go to 5%, at least not anytime soon. Much of what we are seeing today is transitory. Plus, the economy and capital markets would have such a negative reaction as yields rise, it would likely quash any inflationary pressures and plunge us back into a recession. The economy, markets, government have all become rather dependent on yields remaining low. However, over the next 5 or 10 years, the probability of longer-term yields rising materially has increased. And given how sensitive most investor’s wealth is to yields, magnitude of this risk is material.

If we developed a strategy that would have performed rather poorly for the past 20+ years, would it interest you? Probably not, who wants to invest in a strategy that would have received a D? Yet if it performed poorly due to falling yields and would benefit from rising yields, it may just be a great diversification strategy for the years ahead. We are not suggesting overweighting poor performing strategies but incorporating some strategies that would benefit or not be hurt by rising yields may prove wise for the decade ahead.

If this trend has changed, investors will have to become more creative in their portfolio construction, even use some imagination.

Charts are sourced to Bloomberg L.P. unless otherwise noted.

The contents of this publication were researched, written and produced by Richardson Wealth Limited and are used herein under a non-exclusive license by Echelon Wealth Partners Inc. (“Echelon”) for information purposes only. The statements and statistics contained herein are based on material believed to be reliable but there is no guarantee they are accurate or complete. Particular investments or trading strategies should be evaluated relative to each individual's objectives in consultation with their Echelon representative.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. The information contained has not been approved by and are not those of Echelon Wealth Partners Inc. (“Echelon”), its subsidiaries, affiliates, or divisions including but not limited to Chevron Wealth Preservation Inc. This is not an official publication or research report of Echelon, the author is not an Echelon research analyst and this is not to be used as a solicitation in a jurisdiction where this Echelon representative is not registered.

The opinions expressed in this report are the opinions of its author, Richardson Wealth Limited (“Richardson”), used under a non-exclusive license and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. (“Echelon”) or its affiliates.

This is not an official publication or research report of Echelon, the author is not an Echelon research analyst and this is not to be used as a solicitation in a jurisdiction where this Echelon representative is not registered. The information contained has not been approved by and are not those of Echelon, its subsidiaries, affiliates, or divisions including but not limited to Chevron Wealth Preservation Inc. The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete.

Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Echelon and Richardson do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.