2020 will certainly go down as one for the history books. Recent research indicates that financial planning is underutilized in North America. Indeed, Charles Schwab’s 2019 Modern Wealth Survey found that only 28% of respondents had a written financial plan, a surprising figure considering that taking even the simplest steps to construct a financial blueprint can significantly improve feelings of economic well-being.

It seems that one of the underlying causes is a lack of education about how financial planning helps to achieve personal goals. It should therefore come as no surprise that without a clear understanding of how financial planning works, so many fail to implement it.

A Roadmap to Financial Success

Financial success looks different to everyone, but most people have some idea of what it looks like to them. Financial planning, then, is the map that leads to that destination, and wealth generation, tax mitigation, and wealth preservation are the three vehicles used to get there.

Wealth Generation

Wealth generation is the accrual of income and assets over time. The maximization of wealth creation requires careful budgeting and evaluation of various investment and asset management strategies.

Professional analysts aid individuals, households, and institutions in developing budgets, managing cash flow, allocating their funds across different savings accounts, and selecting various investment instruments to engineer diversified portfolios that maximize risk-adjusted returns within their own personal risk tolerance parameters.

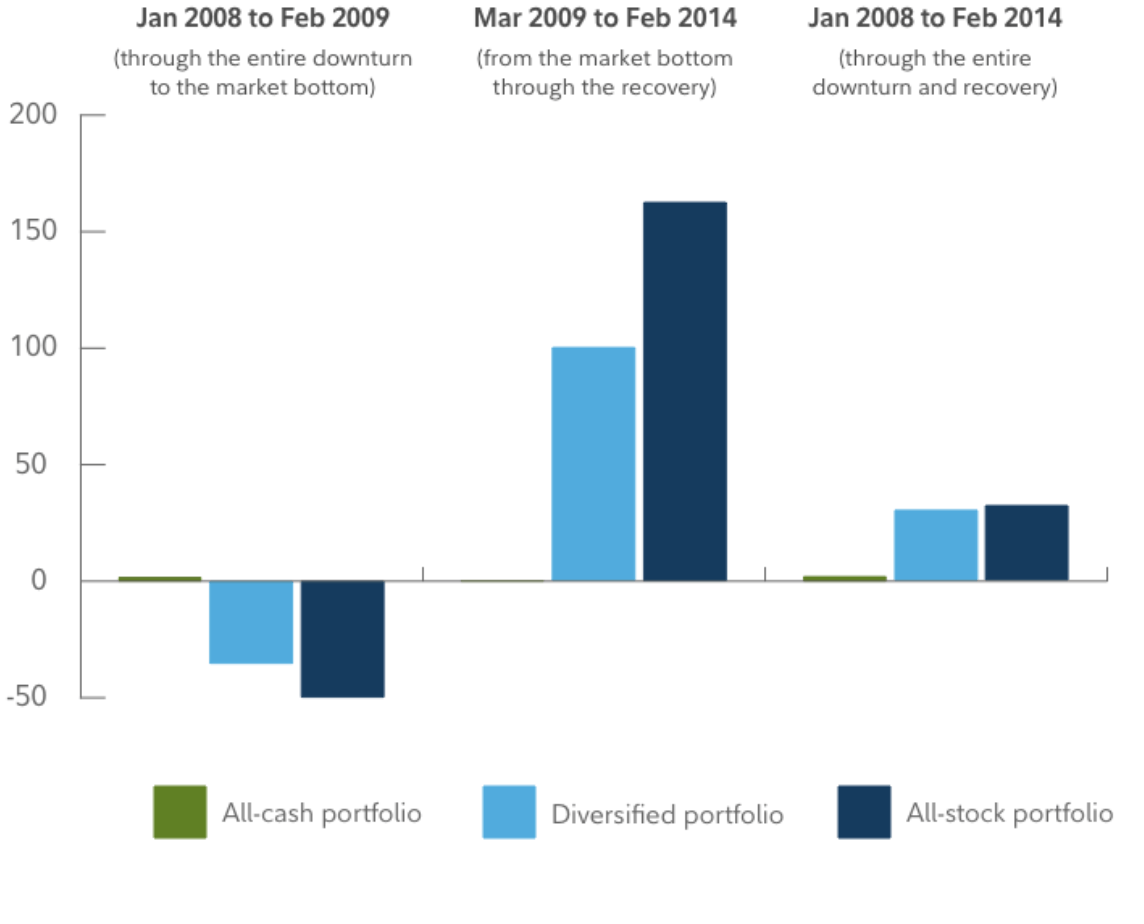

Portfolio diversification, when implemented properly, consistently helps to minimize losses and capture gains, even during periods of global economic distress. The assistance of an experienced financial planner is useful in making the most of diversification and wealth generation strategies.

Tax Mitigation

Getting the maximum return on your investments and retaining as much of your income as possible requires minimizing overhead costs, including taxes. Through careful financial planning, Canadians can reduce their tax exposure and make the most of their investments and income.

Indeed, implementing a strategy that increases after-tax returns by even 1% per year can drastically improve long-term growth.

There are numerous investment strategies and savings structures that can minimize one’s tax burden. For example, if you are planning to pay for your child’s secondary education, you may benefit from a Registered Education Savings Plan (RESP), which provides tax-deferred growth opportunities. Financial planners can help you wade through the many other tax-mitigating options that are available, such as Tax Free Savings Accounts (TSFAs), tax-exempt life insurance policies, and Registered Retirement Savings Plans (RRSPs).

Wealth Preservation

Wealth preservation strategies aim to maintain wealth and assets. Often, there is a specific focus on planning for retirement and ensuring that one’s financial legacy will be properly passed down to their descendants.

Overall, wealth preservation concentrates mostly on minimizing risks through the establishment of an emergency fund, portfolio diversification, and the purchase of annuities, segregated funds products, and various insurance products, such as Term insurance and Universal Life Insurance. Creating a financial plan is essential to selecting the right options to achieve one’s long-term goals.

Key Takeaways

Financial planning helps people reach their short-term and long-term financial goals by implementing strategies that maximize wealth generation, tax mitigation, and wealth preservation. Many Canadians can benefit from working with an experienced Advisor who can help them create an effective financial plan.

Connect with your Echelon Investment Advisor to Discuss your needs, this information or any other questions you may have.

Sources:

https://www.canada.ca/en/employment-social-development/services/student-financial-aid/education-savings/resp/info.html

https://content.schwab.com/web/retail/public/about-schwab/Charles-Schwab-2019-Modern-Wealth-Survey-findings-0519-9JBP.pdf

- Echelon Wealth Partners Inc. is a member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund.

- Unless publications are specifically marked as research publications of Echelon Wealth Partners Inc. (“Echelon”), the views expressed therein (including recommendations) are those of the author and, if applicable, any named issuer or investment dealer alone and they have not been approved by nor are they necessarily those of Echelon. Echelon expressly disclaims any and all liability for the content of the any publication that is not expressly marked as a research publication of Echelon.

Charts are sourced to Bloomberg L.P. unless otherwise noted.

The contents of this publication were researched, written and produced by Richardson Wealth Limited and are used herein under a non-exclusive license by Echelon Wealth Partners Inc. (“Echelon”) for information purposes only. The statements and statistics contained herein are based on material believed to be reliable but there is no guarantee they are accurate or complete. Particular investments or trading strategies should be evaluated relative to each individual's objectives in consultation with their Echelon representative.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. The information contained has not been approved by and are not those of Echelon Wealth Partners Inc. (“Echelon”), its subsidiaries, affiliates, or divisions including but not limited to Chevron Wealth Preservation Inc. This is not an official publication or research report of Echelon, the author is not an Echelon research analyst and this is not to be used as a solicitation in a jurisdiction where this Echelon representative is not registered.

The opinions expressed in this report are the opinions of its author, Richardson Wealth Limited (“Richardson”), used under a non-exclusive license and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. (“Echelon”) or its affiliates.

This is not an official publication or research report of Echelon, the author is not an Echelon research analyst and this is not to be used as a solicitation in a jurisdiction where this Echelon representative is not registered. The information contained has not been approved by and are not those of Echelon, its subsidiaries, affiliates, or divisions including but not limited to Chevron Wealth Preservation Inc. The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete.

Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Echelon and Richardson do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements.