There has been some good news to help markets move higher. Firstly, the banking flare up appears to be fading. Not implying banks are in the clear, but deposits are on the move in search of vehicles with more attractive yields or safer homes. This is negatively impacting some banks (regionals) and benefiting others (money center banks).

Just look at JP Morgan’s latest results, deposits up nicely. Or look at Blackrock that enjoyed strong inflows in Q1 to bond and money market investment vehicles.

Contagion or a systemic risk does not appear to be an issue.

Inflation has improved as well. This was the market’s biggest angst in 2022 so continued improvement is good news.

And while economic growth has been slowing, it has been gradual at this point. The growth has been just enough for bond yields to come down, but not too much to raise the market’s ire over recession risk.

10-year yields in the U.S. have now come down from almost 4.5% to 3.5% and in Canada from 3.5% to 3.0%. If you like the porridge analogy for the economy, the data is cool but not cold.

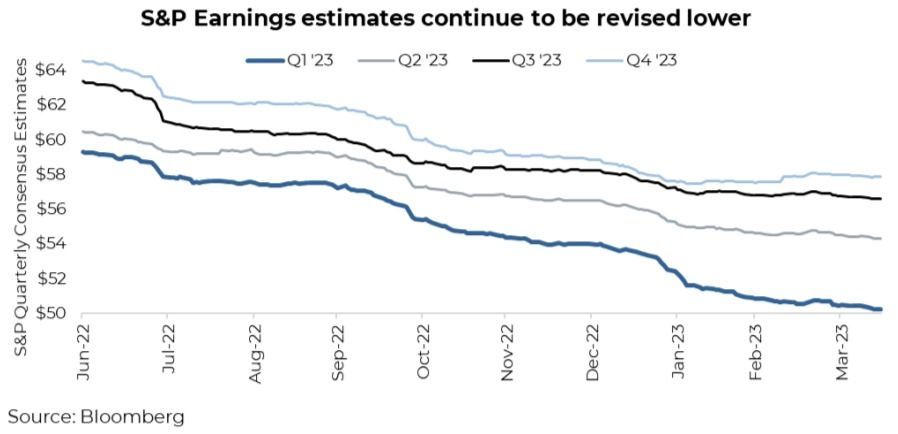

The recent high rally in the equity markets is fueled by multiple expansion, thanks to falling inflation and bond yields. However, falling inflation will prove to be a headwind for earnings going forward. And those lower bond yields — well they are lower because optimism for economic growth continues to dwindle, which is good for lower yields but not good for future earnings.

Final Thoughts

Future earnings are a bit “squishy”. And with the market enjoying the lift from bank fears cooling, inflation cooling and lower bond yields, could it keep going? Of course.

The recent market has been reacting to just about any news as good news: glass half full. And when the Fed finally announces the end of rate hikes, markets may rejoice. However, this advance is being built on a rather shaky foundation.

Don’t be afraid to take advantage of this recent bounce and continue pivoting to a defensive position. Or at least, be ready to do so in case the market switches to a glass half empty mindset.

— Craig Basinger is Chief Market Strategist at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional

advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.