One thing is for certain, if you stopped paying attention to the market for a few days a lot has changed.

Last week, as of Thursday’s close, we saw:

1) The U.S. Federal Reserve raise the Fed Funds rate by 0.75%—the largest single meeting move since 1994.

2) The 10-year Treasury yield climb from 3.05% to almost touch 3.50% then retreat to 3.20%. Canadian yields followed a similar path.

3) The S&P 500 fall 9% from 4,000 to 3,666 (for numerologists, 666 is good for markets as that was the bottom in 2009, minus the 3,000 of course). It's worth noting that the S&P 500 has now given back its 1,000-point gain from 2021.

4) Most other major equity indices fall 6-10%.

5) Bitcoin fall to just above $20,000, off 30% in a week.

We could go on with our list of woes…

There are a handful of popular narratives for this quickened downward pace. The U.S. CPI print that didn’t get worse but certainly didn’t show improvement, the market pricing in a more aggressive Fed tightening path, and increasing signs of economic weakness are likely the top three. We don’t think any of these are surprises, but when the markets are fragile and super sensitive, reactions are dramatic. Let’s ponder on all three.

Inflation – Clearly many market participants thought this was going to be the print that showed inflation coming back down or starting the journey, and it didn’t. Monthly U.S. CPI rose 1.0% bringing the year-over-year pace to 8.6%, both 0.3% higher than consensus forecast and faster than the previous month.

CPI ex-food and energy fell from 6.2% to 6.0%, which is encouraging, but we all have to eat and move about. Food at home is up 11.9% over the past year. Hold onto your grocery stocks. And energy prices are high, as the neighborhood Esso clearly indicates in neon lights. Let’s park the majority of the upward move in energy and food in a supply disruption bucket, namely the war.

Looking across the other CPI categories, there is a trend, and it is all about changing behaviours. Months ago, upward CPI was driven by the consumers outsized demand for goods/services that were in vogue during the heightened pandemic stay-at-home period. Appliances, RVs, patio furniture, home décor, tech, TVs, streaming services—these are the things we suddenly wanted more of. And it totally messed up the logistics supply chains that were arguably more fragile because of Covid disruptions. But guess what, the prices across these categories are broadly coming down.

But, prices are going up on back to normal behaviour categories. Apparel is up, airfares are way up (some energy in that), personal care products and services up, the list goes on.

Things are gradually heading back to normal and a hoody + Lulu pants won’t cut it (even at Purpose).

These kind of broad-based changes in behaviour mess with the economic system and the system is taking longer than usual to re-calibrate. But it is re-calibrating, clearly not this past month, maybe not next month…it’s coming though. This isn’t aggregate demand-driven inflation, it is more changing demand inflation with a healthy dash (maybe a dollop) of supply issues.

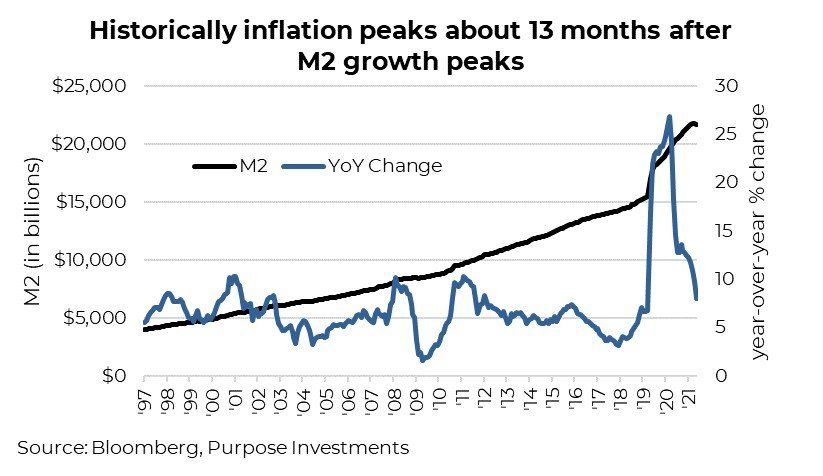

For the Friedman monetarists, respect [MV=PQ]. Maybe we are wrong, maybe it’s not Covid-induced behaviour changes +

supply disruptions, it is primarily about how we jacked the money supply. Maybe

jacked is more appropriate, as we have been swimming in uncharted monetary waters for years now. Don’t remember QE in the trillions being covered in my early 90s economics education. But monetarists must also concede that M2 growth peaked in February of 2021 at a never before witnessed 27% year-over-year growth. Yes, the money supply grew since then but at an increasing decelerating pace and started to contract of late. More importantly, CPI has historically peaked on average about 13 months after M2 growth peaks. Ok, averages are a way to fool the weak mind as it masks over the variability in the data. But still noteworthy that core CPI did peak in March of 2022 and has now declined for two months (March was 13 months after the M2 peak, on the button).

I’ve always preferred Austrian economic thoughts over monetarists. But being open to different thoughts/ideas is how we learn. We could be wrong, and inflation remains up here, gets deeper into wages and expectations.

But our expectation is that inflation will fade as one of the market’s primary concerns.

The Fed – Central banks have made more mistakes than normal this cycle but for all the right reasons. They predominantly held rates abnormally low, given the uncertainly of the pandemic (omicron wave, more specifically), despite rising inflation and really strong economic growth. Fear was that omicron could be like delta, in which case

leaving rates at emergency low levels would have been proven right. But it wasn’t like delta, it was more like a bad flu and now central banks are in catchup mode.

The short-term bond market is well aware. Whether it was 50, 75, or 100bps, doesn’t really matter beyond a day or two gyration, the path is clear and will likely only change if the economic data gets soft enough (which has started in that direction).

Don’t fight the Fed is a solid rule of thumb for investors. However, it’s worth noting that this rule was cemented when the Fed moved in mysterious ways and changed policy without notice. Today’s Fed talks a lot and then puts it into action. Maybe today should be more, “don’t fight the 2-year” as the bond market kinda knows ahead of time.

If you are married to “don’t fight the Fed,” at least don’t listen to the Fed. One reason cited for the 75bps move was recent consumer survey data regarding inflation expectations. Survey data is very valuable—it is often timely and can offer some insight into people’s behaviours. Unfortunately, survey data has been a bit squirrely over the past couple years. For instance, consumer sentiment has been below Covid trough levels for over a year and are currently well below the depths of the global financial crisis (GFC).

To refresh, during the GFC, people were getting wiped out financially and the core of the financial system was at risk of imploding. Today, gas prices are high, and everyone still has a job. The Fed is raising quickly because they are late…no need for the fluff.

Watch the 2-year yields, clearly implying the Fed has a bunch of hiking to do. But if the 2-year starts to stabilize or come back down, that may be the sign the Fed will be changing paths. And the 2-year will move

on to economic data…

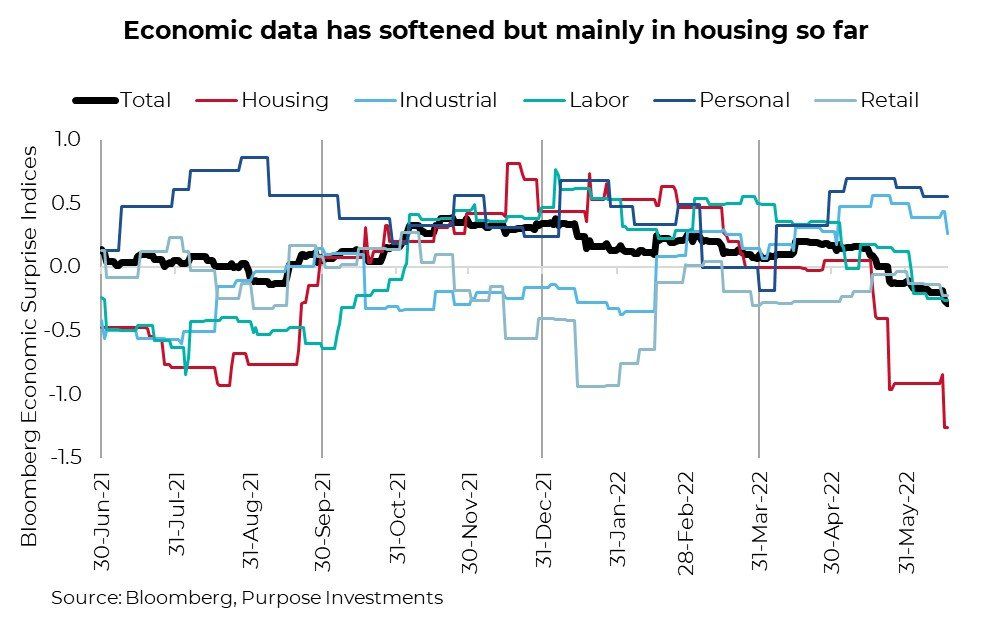

The Economy – It is slowing, and recession fears may be on the path to become bigger than inflation fears. You don’t have to look very hard or far to see some signs of slowing. The faster indicators in housing are under a lot of pressure, which is not surprising given the move in mortgage rates and resulting drop in home prices. This is clearly evident in the

Bloomberg Economic surprise indices. Housing is that red line, clearly getting softer. But other categories are flattish or even positive. Industrial, which captures manufacturing, remains decently strong. Generally, as goes manufacturing and

housing, so goes the U.S. economy. At the moment, it’s mixed.

European data has started to come in a bit better than expectations and China is showing signs of recovery as lockdowns ease and stimulus is added. Yes, the world is zagging (tightening financial conditions), and China is zigging. You may not have noticed but while most markets are down a good amount over the past month, China is up.

Recession talk will likely grow louder as the year progresses, which will continue to be a market headwind. This of course brings up the question: has the market already gone and priced in a recession? Probably not, but valuations are

really interesting. Often, we quote the aggregate market valuation; instead, we looked at how many companies are trading below 10x (aka single digit PE ratios) and compared this with a year ago. About 1/3 of the TSX is sub 10x and a ¼ of the Russell 3,000, which captures most of the U.S. market.

Investment Implications

The markets have been bouncing from one problem to the next this year, and nobody knows when some stability will return. Markets and risk assets are clearly oversold, and valuations are becoming increasingly attractive. That being said, this market is cranky and fragile.

Our base case remains that as the economic data softens, the inflation fears will too, leading to a market bounce.

But we could also fast forward to recession fears as earnings/margins come under pressure. Valuations are increasingly providing some margin of safety, but this will continue to be a challenging year.

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional

advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.