Okay, we will start this week with full acknowledgement that this edition is a bit self-serving; it’s about thematic investing, and yes, we launched a thematic-focused strategy last week. But we would like to share ‘Why’ we created this strategy, beyond the obvious fact that we manage money. We believe investors face a number of big hurdles when investing in thematic ETFs, which we are trying to address.

The essence of thematic-focused investing is, at its core, a really good idea. There is no denying that the world changes over time, and often there are long-term tectonic shifts. In years past, we have all witnessed the rise of smartphones, or the rise of cloud computing, and healthcare spending due to advances in solutions and aging populations. Identifying these trends isn’t that difficult as they become increasingly evident as society evolves and behaviours change demand patterns.

More recent themes include EGaming, cyber security, AI and the ever-popular rise of electric vehicles (EVs). Securing electronic data in an ever more electronic world remains a top priority for people, companies and governments. Demand to secure data from unsavoury characters is something that will likely continue to grow faster than the overall economy for many years to come. Or EVs, which continue to gain market share among total vehicles sold, is forecast to continue for many years, if not decades.

Naturally, creating an ETF or fund that attempts to capture one of these faster-growing or exciting themes is a good idea. And investors agree if you measure agreement by the inflows into thematic ETFs. The previous chart is the number of shares outstanding in thematic ETFs, which has exploded over the past few years. We use shares outstanding instead of market value as this avoids the impact of changing market prices. Even in the past couple of years, which have been more of a risk-off environment for investor appetites, thematics have increased.

BUT, there are some hurdles investors face with investing in these high growth potential thematic ETFs.

1) Which one(s) to invest in?

To put it plainly, thematic ETFs can offer outsized returns, but they can also offer outsized losses. The variability or disparity of performance is massive. If you are buying a Canadian bank and you pick the wrong one, it’s unfortunate, but the disparity is low, so not too much of an issue. Pick the wrong thematic—yikes. What if you chose the Marijuana theme? Tough times of late. More optimistically, if you picked AI, you won.

The nearby chart is the 50 largest thematic ETFs listed in the U.S., showing the 1-year price change. Yes, you are reading the chart correctly, that is from +47% to -32%. Even those poor-performing themes are still enjoying a long-term growth trend in their industry. But investor appetite is a fickle thing; it can change a lot from one year to the next. Or a theme can experience a headwind of some sort or another, such as changing legislation.

Pick the right one, you win. Pick the wrong one, you lose. Even some of the poorest-performing thematics over the past year are still focused on a theme that has great prospects. Some are down because they simply went up way too far the previous year. Picking who will win in the next year, now that is challenging.

2) The lure of performance chasing

Performance chasing is evident in all kinds of investing; it is very evident in the thematic space. An artificial intelligence (AI) ETF is one of the big green bars on the left of the previous chart. Up about 40% over the past year, with all that gain reached by the end of May this year. In other words, flat over the past five months. At the end of May, there were 9 million shares outstanding for this ETF, today, there are 24 million. In simple terms, most of the money in that ETF came in after its gains.

To further show this performance chasing, we broke down thematic ETF price range into four equal buckets (quartiles). Quartile 1 was the lowest 25% of prices over the past five years. Quartile 2 was the next 25%, still below average but not as cheap. Quartile 3 is above average, and Quartile 4 is the most expensive. We then measured ETF flows during these four price ranges.

Guess what? The VAST majority of inflows from investors occurred during the more expensive price ranges. In fact, during the cheapest quartile, there were outflows. Buy high, sell low has never been a viable long-term strategy.

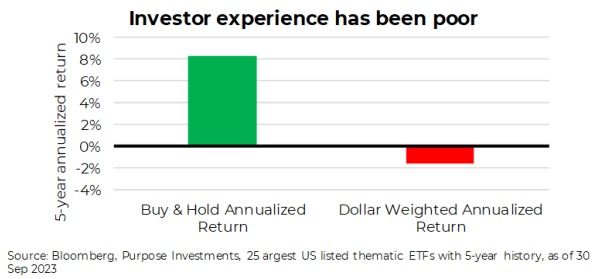

With the same universe of thematic ETFs, we measured the actual return experienced by investors using money-weighted returns. Comparing this dollar-weighted return to if an investor had simply held the ETF all along. This is more evidence that the average investor has had a tough go with thematic ETFs.

3) No sell discipline

Contributing to the previous evidence of poor timing is an apparent lack of sell discipline. Even thematic ETFs that have seen their share price fall 40, 50 or even 80% over the past few years have seen very few sell. One of the largest thematic ETFs in the U.S. is down 75% since early 2021 and still has about the same number of shares outstanding. Congrats on being a stable investor and sticking with your conviction. Unfortunately, you are now poorer.

The challenge is, if you believe in the long-term theme, why would you sell? Yes, 50% of cars sold in 2035 may very well be EVs, so just stick with the EV thematic ETF and ride out the peaks and troughs. But what if the composition of the ETF doesn’t capture the theme as the companies involved change over time? Most auto manufacturers now sell EVs, clearly not pure plays like in years past when it was just one or two new companies making EVs. One of the biggest EV ETFs was up 62% in 2020, up 28% in 2021 and down 34% in 2022. Yet the theme continues its path.

Unfortunately, you can’t use valuations as a sell signal. Many times, the underlying thematic companies are very expensive to begin with. They can become more expensive and may still be expensive even if they fall by 50%.

A lack of sell discipline and stubborn attachment to thematic ideas has caused many investors to take the full ride, up and down. Sometimes, it’s more down than up.

Final Thoughts

Thematic ETFs can offer a growth boost for portfolios. Plus, given the composition of the TSX and its lack of growth (lots of dividends, not as much growth), many Canadian investor portfolios are light on the growth factor. There are many options available, covering many different themes, from many different ETF providers that could actually experience a positive tailwind for many years. But the data clearly points out that picking a theme or two or five and jumping on board is not the best path.

Thematic ETFs are an exciting part of the market that lack a disciplined investment process. To help solve this problem, we launched our strategy.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional

advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.