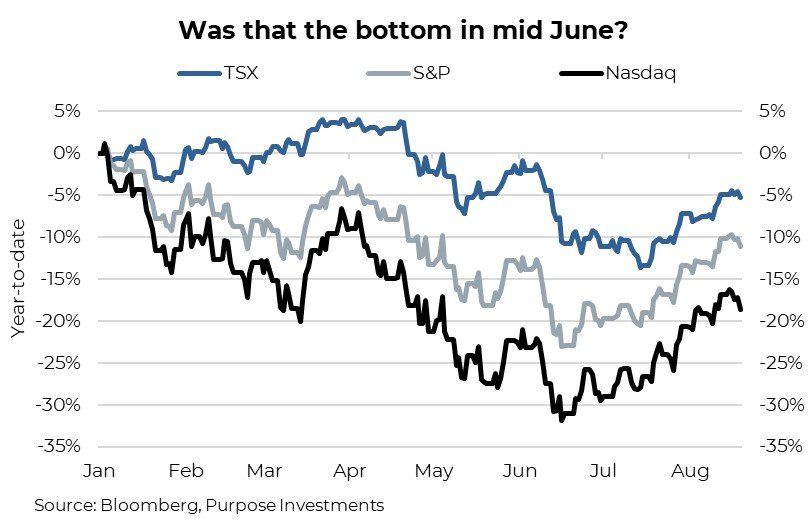

In the history of bear market bottoms, the recovery is ALWAYS questioned for months with tons of well-founded convincing naysayers. Over time, the negative nellies concede it's over, and markets return to their normal upward trajectory. Could this be that? Maybe. But count us in the 'naysays' camp after this market rally. We turned much more positive at the beginning of July in our outlook for the 2nd half (HERE). This was predicated on a few things, including the degree of the drawdown, the view that inflation would begin to soften, and that recession fears were a bit overblown. But this advance does appear too far and too fast.

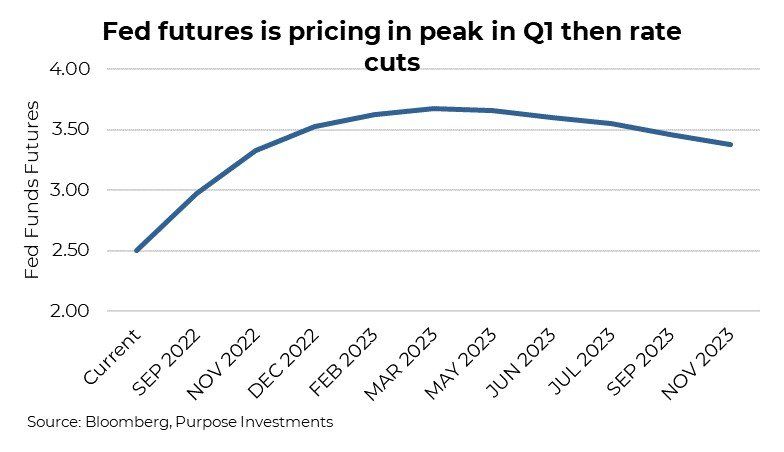

Short covering combined with some softening inflation data and improved economic data, which allayed recession fears during the less liquid summer months, drove this rally. And now, the market is gambling on a perfect future. Think about it.

The S&P is down 11% from a high that was a bit of a speculative peak to round out the +28% appreciation in 2021. Down only 11% with inflation softening but still a risk. Down only 11% with earnings revisions turning negative, the Fed is still on hiking autopilot and, despite a few

recent economic data points, recession risk is still real.

This market appears to be sitting on an open-ended straight, hoping for a good river card. Maybe inflation will come down fast enough, allowing the Fed to stop raising rates. Maybe yields will stabilize, the economy will have a soft landing and earnings growth won’t slow materially. Or maybe this market rally just keeps going higher on short covering of bearish bets. It could happen, but the probability does not look great.

This has been the summer bounce rally. Market Ethos June 20th:

“Our base case remains that as the economic data softens, the inflation fears will too, leading to a market bounce. But we could also fast forward to recession fears as earnings/margins come under pressure. Valuations are increasingly providing some margin of safety, but this will continue to be a challenging year.”

That valuation safely margin has certainly been reduced. In early July, the S&P 500 was back down to its long-term average of 16x forward estimates. Now it is back up to 18x, not expensive, but if you are less confident about the sustainability of the ‘E,’ certainly less safe.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional

advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.