2023 may not be over yet, but with only a few weeks left, it appears to have been a great year to be an investor. Global equities are up about 15%, led by the S&P and Europe at +20%, followed by Japan at +13% and the TSX at +7%. Remember that the TSX held up much better in 2022, so don’t fret too much. The news keeps getting better as bonds went up, too. Looking at the broad market ETFs, Canada is up 5%, while U.S. bonds are up 4%. The cherry on top, you also got paid to sit in cash somewhere in the 4-5% range.

Despite all these healthy 2023 returns, we’ve noticed from our interactions with advisors and speaking at client events that investors seem a bit disgruntled. So why are investors not enthusiastic about what appears to be a pretty darn good year? It could be inflation makes people less happy or it could be all the recession talk. However, we think it is something even simpler. Despite the gains this year, it has just taken too damn long for markets to recover back to previous highs. Global equities, S&P, and TSX are all still below their previous highs reached at the end of 2021 or even longer for bonds back to 2020.

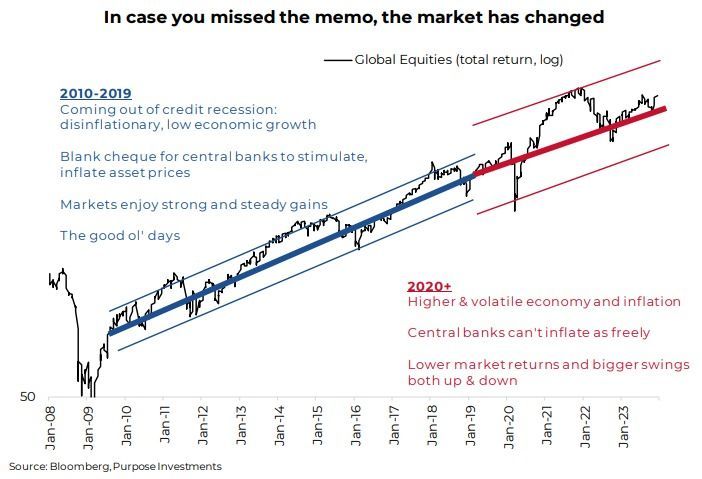

This is now the longest drought without all-time highs since the great financial crisis of ‘08/’09. Investors clearly expect better from their investments, likely a learned response from the ‘buy the dip’ era. The ‘buy the dip’ (BTD) mantra was steadily reinforced during the bull market from 2009 to 2020 and then reinforced with concrete + rebar during the Covid market drop and recovery. The lesson was simple: if the market goes down, buy some. If it goes down more, buy more. Then sit back and wait a few weeks for prices to recover, wait a few more weeks, and new highs start to pile up. Easy-peasy.

Unfortunately, the BTD era may be over and not simply because it has been almost two years since equity markets made a new high. The BTD era was created thanks to a confluence of factors:

- Following the 2008 credit recession, there was a disinflationary blanket on the economy, as consumers & banks reduced leverage. This created a lower-growth world with a greater risk of deflation vs inflation. This helped yields gradually move lower and allowed central banks to stimulate (QE) anytime the economy or market stubbed its toe.

- Valuations at the start of the BTD dip era were very low, well below historical averages. Valuations often revert to the mean, and this provided an added steady positive influence on asset prices.

This created a market, both equities and bonds, that weakness proved very short-term as there were factors or stimuli that would mitigate any pain and speed the recovery along. It was a great time to be investing and an even better time if you enacted the BTD strategy.

The current market is certainly different. The disinflationary blanket that enabled central banks’ free stimulating ways, are over. Inflation is now a thing again (just like before the BTD era). Central banks now have to balance price stability with economic growth. Speaking of economic growth, it too has started to become more volatile. Just look at negative GDP in Germany, Japan and Canada, flat GDP in the UK and still strong GDP in the U.S. Plus, valuations are now more on the expensive side of historical averages.

The ingredients for the BTD era appear to be gone. It was fun. There is something else afoot, though: dispersion. The BTD era enjoyed less dispersion than normal. Dispersion across markets, across asset classes, across sectors and across equities was lower. The simple explanation for this was that it was a more macro�driven market. The macro dominated performance, often dwarfing things like company fundamentals or valuations. That actually made investing easier, you just needed market exposure or beta. It didn’t matter as much how you got it.

The chart below is the S&P 500 sector performance dispersion over time. Recessions or bear markets certainly make dispersion spike higher as defensive sectors hold up better than those that are more economically sensitive (usually). More importantly, looking at non-recession periods, current dispersion is much higher than before.

Now, you may be wondering why you should care about dispersion. It is evidence that the market is becoming more micro-driven. Company fundamentals are starting to matter more, leverage matters again, and how a company or investment can handle higher yields or inflation matters. From 2010-2020, it was more of a macro beta-driven market. Not saying the macro drivers are gone, but it would appear there is more of a balance between the macro and the micro. Just look at the dispersion in performance in 2023 among sectors for the S&P and TSX… it’s HUGE.

Final Thoughts

Don’t get us wrong, we are not saying buying into market weakness isn’t going to work or not enhance longer-term performance. But it may not be as quick a positive feedback experience as it has been over the previous decade. Nor are we saying the macro drivers are not still very impactful on performance. But the micro is starting to matter more again.

— Craig Basinger is Chief Market Strategist at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional

advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.