The primary cause of the market declines in 2022 was inflation and the subsequent response by central banks. Rates higher, yields higher, stock prices lower… yuck. The stock market rally in 2023 was a bit more complicated but a big driver was inflation coming back down, opening the door for central banks to stop raising rates and for bond yields to stabilize. Yay. Now with 2024 well underway and the equity market up smartly, should we be concerned that inflation doesn’t seem to be going quietly into the night?

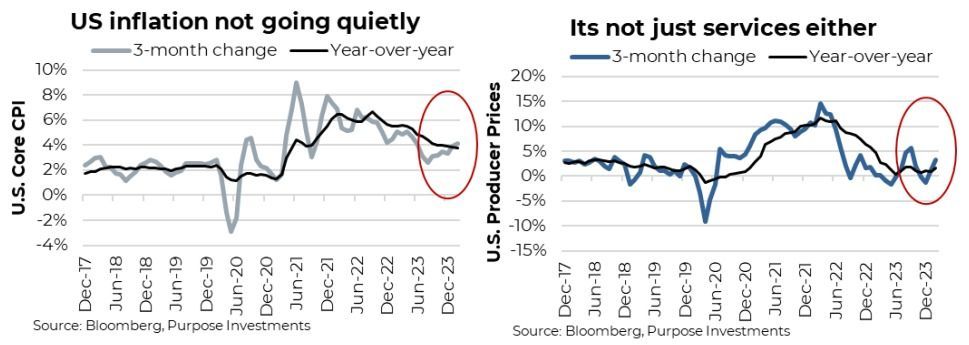

Last week, the U.S. Consumer Prices Index (CPI) data came in a bit warmer than expected by the consensus. The month-over-month change was 0.4%, both headline and core, excluding food and energy; this brought the year-over-year to tick up a bit from 3.1% to 3.2% and the core from 3.7% to 3.8%. This probably wasn’t a big deal; the equity market shrugged it off, and bond yields moved a bit higher in response. We could argue the finer details, such as insurance moving higher or shelter, but really, it was a lack of price deflation in goods. Good prices had been falling for the past six months, helping overall inflation come down. There was further evidence goods deflation may be waning in the Producer Prices data released later in the week. The market had more of a negative reaction to this information.

It gets a bit more challenging as well due to base effects. Given more folks pay attention to the year-over-year inflation reading, this is poised to move higher. It had been moving lower partially because, for the past six months, the monthly number being dropped from a year ago averaged 0.4% (high-ish). So, any monthly reading below this 0.4% would result in the year-over-year reading falling. However, we are about to drop a number of months that averaged much lower inflation, so future months will need to be below 0.2% to see headline CPI fall.

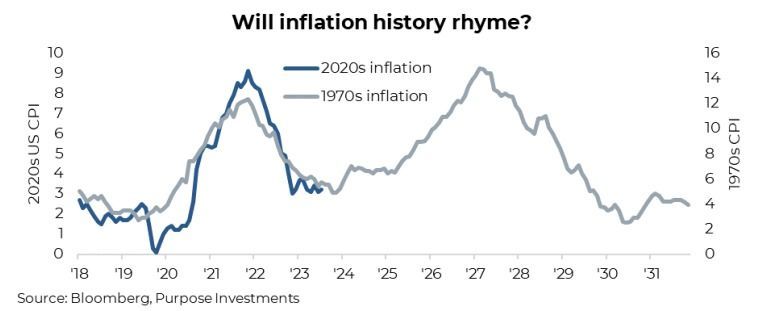

A resurgence of inflation, even if partially due to base effects, will likely see more folks talking up similarities with the 1970s. The 70s saw an initial move higher in inflation, which faded and then rose again. Please note I just jammed an entire decade of inflation into one sentence, which is an oversimplification. In reality, there were many twists and turns along the way. While this is certainly possible, we would point to a major policy mistake in the 1970s. The Fed started cutting rates even before inflation peaked. Of course, hindsight makes it easy to say this today. Recently, the policy mistake was to wait too long before raising rates and then to maintain a restrictive level as inflation has come down. Worth noting a recurring trend has been for the market to keep pushing expectations of rate cuts further out.

Also, it's fair to say this just isn’t your 1970s economy. Even if inflation does pick up in the near term due to base effects, the trajectory should remain to the downside over the next year. Shipping prices have ticked higher, which feeds into goods pricing. Commodity prices have moved up recently as well. On a positive, if you look at factory pricing in China, this continues to be disinflationary. Yet most developed economies are more tilted to services than goods. U.S. CPI is broken down into 14% food, 7% energy, 19% goods and 60% services. The good news is services inflation doesn’t move around nearly as much as other components; the bad news is that it moves very slowly.

Despite goods inflation ticking up of late, investors should not read too much into this as it tends to be more volatile. More importantly, the lagged inflation components are starting to roll over. The two biggest drivers of services inflation, rents and wages, are cooling. Small business wage and price intentions are softening. This should help inflation continue to cool as 2024 progresses, albeit not in a straight line that can include some countertrend moves, like the one happening right now.

Why All This Inflation Talk?

Inflation is essentially a tax on wealth; higher inflation makes everything worth less in real terms. This includes your portfolio. Even though we believe inflation is likely going to become lower, it may flare up further downfield. Many of the factors that helped keep inflation lower or moving in a downward trend during the past couple of decades have softened. Inflation may well become a recurring risk to portfolio and financial plans. Ensuring a reasonable allocation to asset classes that can help offset will likely become a larger allocation in the years ahead. This includes equities, more on the value factor, and real asset exposures.

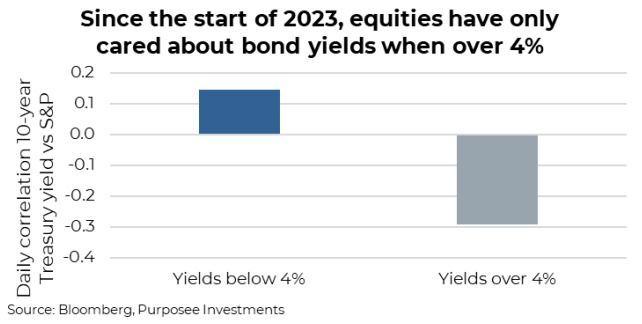

More importantly, for today, any variation in the path of inflation can quickly translate into bond yields. The recent CPI and PPI prints triggered the 10-year U.S. Treasury yield to move up from about 4% to 4.3%. That may not sound like a big deal, but over the past year or so, the equity market has been very sensitive to bond yields when above 4%. What does that mean? Well, when bond yields have been below 4% since the start of 2023, there has been a weak relationship between the movement in bond yields and the stock market. However, when it was over 4%, this relationship became much stronger and more reliable.

This relationship will not endure as other factors will become more impactful. For now, though, the equity market does not like yields moving higher when above 4%. The good news is that when yields fall, the equity market will potentially rejoice, as it did when yields fell from 5% at the end of October to 4% by the end of the year.

Final Thoughts

Given our current view that this recent uptick in inflation will prove to be a short-term counter trend, we don’t believe the rise in yields will persist either. And should it move further, that may create another bite at the apple to add duration. Or even add equities if it translates into equity market weakness. For now, we are not getting concerned over the uptick in inflation data.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional

advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.