Canadians love hockey, and why not?

On a per capita basis, we are really good, producing some of the greatest players of all time. Another thing Canadians love is dividends or, more aptly, dividend-paying companies. So are we also really good at producing some of the greatest dividend-paying companies? That might be a stretch. Investors love dividends for all the reasons you can read in the generic marketing material for the space – less volatility provides income to the investor that is taxed less than other sources, etc.

There are a couple of other reasons Canadians love dividends. Our banks didn't have major issues in the 2008 global financial crisis, which certainly helped, given their large representation in the dividend universe. And who's kidding who? Do many Canadian investors have fond memories of buying Canadian growth stocks? That is almost like a field of broken dreams.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used herein under a non- exclusive license by Echelon Wealth Partners Inc. (“Echelon”) for information purposes only. The statements and statistics contained herein are based on material believed to be reliable but there is no guarantee they are accurate or complete. Particular investments or trading strategies should be evaluated relative to each individual's objectives in consultation with their Echelon representative.

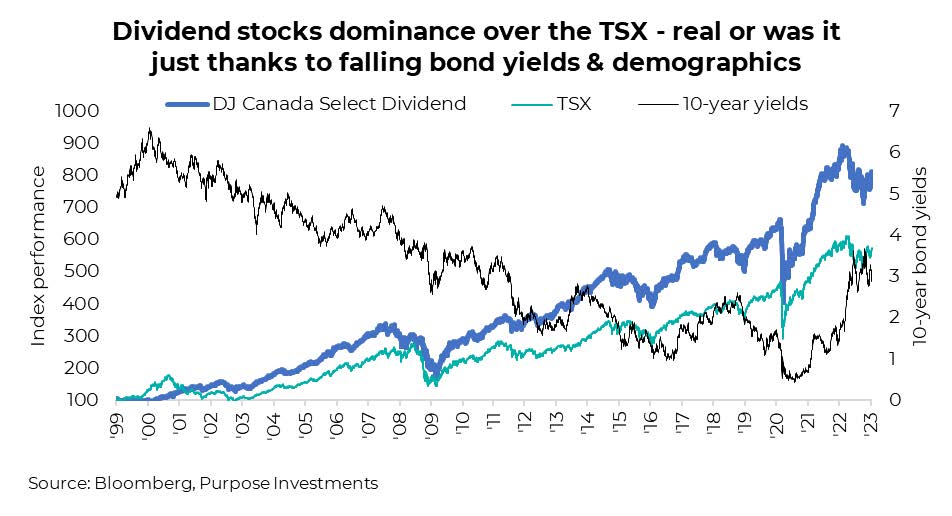

But investors should acknowledge that dividend investing, or the dividend factor, has enjoyed a steady lift over the past few decades from falling bond yields. A few years ago, it was pretty straightforward; bonds paid very little, and dividend-focused equities paid more. Sure there was more volatility than bonds, but it was less than the overall equity market, and the distribution enjoyed an after-tax advantage. The term 'bond proxy' even came up, referring to utilities, consumer staples, real estate or other dividend-heavy sectors that tended to move in tandem with the bond market.

Given bond yields are now higher and potentially more variable going forward compared to years past, is this an issue for dividend investors? You can now receive a much healthier distribution from bonds and even from cash. If you ignore the drop and pop in yields right around the pandemic onset, the 10-year yield really started rising on its own accord around mid-2021. Coincidentally, the TSX has outperformed the equivalent dividend-focused index since then. We believe dividend-focused allocations should remain a core for Canadians' portfolios, but the dynamics have changed.

Dividends in 2023 and the next cycle

Starting points matter from both a price and valuation perspective. And dividend-paying stocks are cheap. The charts below are for the U.S. and Canada, contrasting dividend index valuations against their own history and the broader market. Valuations are low for a reason because yields have risen, and there is a higher degree of uncertainty about a potential recession. However, these low valuations provide a safety buffer in the cohort of equities that are historically lower beta. If this bear is not over and we have a potential recession ahead, dividend companies, in general, should provide a better margin of safety.

But even now, it is not the same as before. We took the largest dividend-focused ETFs available in Canada and measured the dispersion of performance over time (chart). The dispersion or variability of performance was low and stable for much of the 2010s. This was simply because falling yields lifted all dividend-paying companies. Not exactly to the same degree, but it was likely the dominant force. However, more recently, there has been an increased dispersion of performance as the finer intricacies of each mandate's holdings have become more impactful.

This divergence is being driven by different factors impacting dividend-paying companies differently. Which then depends on the difference in weights of those companies among the dividend products. It just got a bit more complicated. Here are some of the considerations that appear to be starting to drive performance more so than before:

- Debt – Little thought was given to the balance sheet in the last cycle, which is now of greater importance. This includes not just the company's debt but its maturity, types of coupons, etc. Recently companies with more variable debt have been under pressure, given the prevailing rates.

- Yield sensitivity – it may be declining in importance, but it still matters. Some dividend companies tend to be more or less sensitive to changes in yields than others. Historically we have broken the universe down between interest rate sensitives to cyclical yield.

- Economic sensitivity – This is not just how sensitive a company's operations are to the economy but which economy. Of late North American sensitive companies have lagged behind those more sensitive to the global economy as China re-opens.

- Pricing power – Yes, inflation is starting to fade but cost inflation is still strong. How much ability does the company have to pass on higher costs to customers?

This is an abbreviated, simplified list, as it really comes down to direct company analysis. And what value or price is that company being valued? Which does raise a problem depending on the dividend strategy. Many products (ETFs and Funds) and dividend portfolios using direct equity investments tend to be very static. This worked when the companies were all being lifted by falling yields. However, if fundamental factors are becoming more important to the performance of dividend-paying companies, such a static approach may prove challenged.

Portfolio Considerations

We are positive for a continued healthy inclusion of dividend-focused companies in most Canadian's portfolios, whether held directly or from an ETF/Fund. That being said, investors should start to consider allocating more towards actively managed dividend strategies compared to more static or rules-based approaches. The drivers of performance are likely going to change over time, which we have already started to see:

1H 2022: as yields rose, the most interest rate sensitive dividend companies suffered the most (aka bond proxies), and the more cyclical yield names did better.

2H 2022: More recently, the bond proxies have been recovering as fear moves from inflation to potential economic weakness or recession. And the more economically cyclical dividend payers are split – those that are sensitive to the North American economy have lagged, and those more sensitive to the global economy and China re-opening have led.

2023: we continue to believe leaning into defensives is best as the magnitude of the economic slowdown becomes more clear. Would note that real estate is now pricing in a very draconian future, which is likely overdone. And the banks, which benefit from higher yields, are carrying historically low valuations. Perhaps due to a potential real estate speed bump ahead for their operations. Still, the world is changing from one in which the borrowers had all the power to one where lenders are in control.

In short, this is no longer the old dividend universe where you could cobble together a dozen dividend-paying names, buy them and forget it. It now has many moving parts that beget a more active and forward-thinking approach.

— Craig Basinger is a Portfolio Manager at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional

advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.