There has certainly been more good news in the markets over the month or so.

Inflation stopped going up, and even appears to have softened a smidge. As we discussed, this is a bear market caused by inflation, so when the root cause begins to improve, the market reacts very positively. Equities moved higher. Bonds moved higher. It’s a beautiful, enjoyable thing. It is not just inflation; there are positive global growth signs that things may be improving. China has some encouraging signs. Due to the efforts of many, the European energy crisis this winter has moved from a certainty to a maybe (very weather- dependent, of course). The market is now pricing in a 50bps rate hike in December (not 75) and then two more 25s before peaking in May. Even more talk of the infamous soft landing.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used herein under a non- exclusive license by Echelon Wealth Partners Inc. (“Echelon”) for information purposes only. The statements and statistics contained herein are based on material believed to be reliable but there is no guarantee they are accurate or complete. Particular investments or trading strategies should be evaluated relative to each individual's objectives in consultation with their Echelon representative.

We are not buying it. This appears to be another bear market rally, and maybe it even makes it to the holidays or into 2023. With the S&P back to trading almost 18x forward earnings, which are being revised lower, the more this rally goes, the less sustainable it becomes. Not the least of which, if it goes too far (which may already be), financial conditions will loosen, countering the central banks’ efforts. And then they will say some not-so-nice things (more on Fed talk later).

It is worth noting that hiking rates by central banks is estimated to take 6-12 months to impact the economy. Maybe the economy reacts faster now, but if this lag is the case, then only 25 of the 375bps in rate hikes has been felt so far by the economy, which is starting to slow down as we head into 2023. Leading indicators have rolled over, which rarely lines up with fun times in equity markets.

As we lead off, there is good news out there. It is common that a bear market typically ends initially on a rally supported by hope, which then needs fundamentals to come in to support. The risk is the faster this market moves higher, the quicker those fundamentals need to come in, and so far, there are not many signs.

From rising prices to falling earnings

After what was a challenging year for investors, the markets rally off the October lows has been a welcome relief. It’s broken through a number of common technical resistance levels, which has caused quite a headache for the bears. It’s also been broader than even the major index levels indicate. With the S&P 500 nearly at 4,100 and up over 17% off the bottom, the major issue for investors is where do we go from here. The overwhelming tide of bearish sentiment has dissipated. While investors are far from being overly optimistic, our major concern at this interval is that Mr. Market has become a little complacent. It’s often said that complacency breeds contempt, and just because a situation has become familiar doesn’t mean it is no less hazardous.

The bear market began with the NASDAQ peaking in November 2021, so it’s now over a year old. Happy Birthday? Over the past year, it’s become rather routine to hear about rising rates and inflation. Peak fear and uncertainty surrounding these two matters are likely in the rearview mirror. The market is pricing in peak rates in just a little over six months, and based on the latest data, inflation has also peaked. Of course, it’s premature to conclude that either of these matters is no longer a concern, but with all of the attention focused primarily on these two, the next big surprise for investors is likely to come from the periphery.

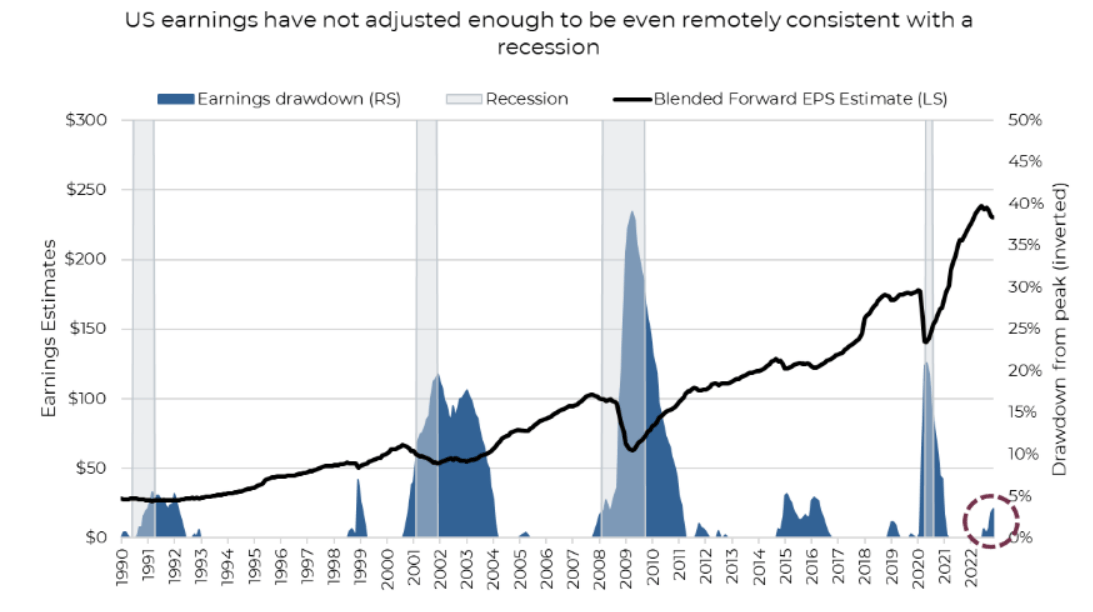

At present, we’re using the relief rally to begin to decrease exposure to riskier assets. We don’t know when the rally will end, but it’s run long enough to begin to dial back exposure. Of course, we’re still concerned that inflation will drag on longer than expected, but more importantly, corporate earnings are too optimistic for 2023. For the market to extend its rally into next year, at least two things will likely need to happen. Corporate earnings will have to rise, or multiples will need to increase. Multiple expansion is certainly a possibility, but with the S&P 500 back to 18x earnings and yields where they are, we find that hard to believe there is much more upside from multiple expansion. 12-month forward earnings per share (EPS) estimates for the S&P 500 are currently at $235, which is 7% above the expected full-year 2022 EPS estimates. Negative revisions have picked up, with estimates for next year now down 4% from their peaks, as you can see in the chart below. What’s interesting is the expected earnings drawdown is not remotely consistent with a potential recession or even a meaningful economic slowdown.

Next, there are margins. Companies face a worsening macro picture and risks to corporate profit margins due to ongoing higher costs and less appetite from consumers to digest persistent price increases. Price growth has likely reached a point where it is destructive to volume growth. We’ve started seeing this for some companies and expect this trend to broaden next year. The chart below shows that margins have already come under pressure but remain historically elevated.

Central banks remain intent on reining in inflation by suppressing growth. Slowing growth is not conducive to high profitability, and this decreases the likelihood that margins will maintain at current levels. Besides demand destruction, labor strength remains strong on the costs side, and high wage growth will become increasingly difficult to offset. Input costs also remain elevated, with many commodities beginnings to show renewed strength. China moving away from their Covid-zero policy may also push commodity prices even higher. Inventories have also risen over the past year, and this excess could be another risk. Margins tend to be mean reverting, and we see them drifting lower from here.

As margin pressure continues to build, this puts earnings at risk. Investors should prioritize companies that have strong balance sheets, resilient cash flows and a focus on shareholder returns (dividends). Our view is that market turmoil will continue as the economy slows. The timing and magnitude of a potential recession are difficult to forecast, but we remain confident that a defensive posture is most appropriate. In the meantime, we’re growing much more comfortable with the income and renewed resiliency in bonds.

Actions speak louder than words

For any of our readers who have watched one of our team members present on a zoom, or even better at a live client event (FYI, those are back on), you may have heard us comment that we tend to ignore what central bankers say. This may seem ignorant given the S&P 500 popped 3% last Wednesday, with the gains kicked off at 1:30 pm during Fed Chair Powell’s update on the economy and laborour markets. With the wording that the pace of rate hikes will slow, markets rocketed higher. So how can we advise to ignore what the Fed says, given the market certainly listens and reacts?

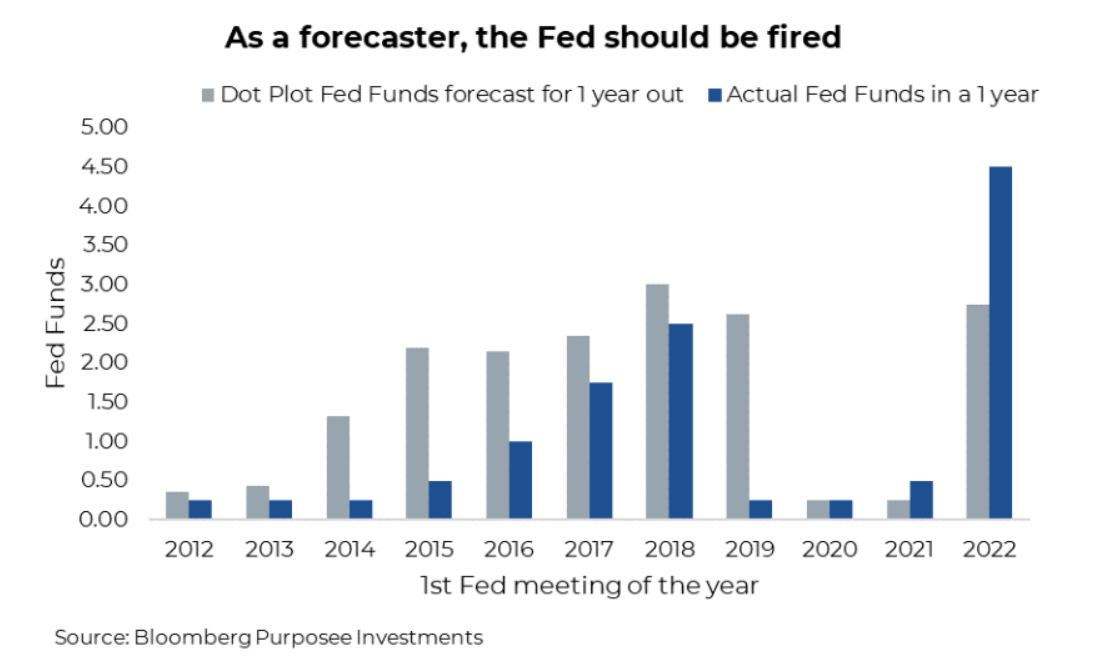

First off, trying to guess or position for daily moves is a strategy few have a skillful advantage. This is a bear market, and even attempting to explain daily moves after the fact can sometimes be challenging. More importantly, let’s take a look at what central bankers have told us in the recent past, in this case, the Fed. In mid-2021, inflation was labelled “transitory,” and rates will stay lower for longer. Whoops. By the end of 2021, still actively buying bonds, albeit at a slowing pace, despite a rocking economy and inflation now over 5%. Whoops. In 2022, policy pivots, and so does talk, ‘inflation is the sole focus now for the Fed’ (paraphrasing). So now we are to believe they are backing off? Perhaps.

Central banks use comments and statements as a policy tool – they always have. This leads to speeches that focus on what they want the market/investors to do, managing the markets and expectations to a degree. And nobody seems to mind that their ‘dot plot’ has a terrible record for accuracy beyond a few months (chart). The fact is, it is

the data that will dictate the path of the Fed funds rate, regardless of their statements on any given day. They have the same data as everyone else and are motivated to talk the market in one direction or another.

We are not saying ignore the Fed or other central banks. The opposite. Pay careful attention to what they are doing and less to what they are saying. Markets of late remain very sensitive to variability in stimulus or liquidity. You may believe the Fed is smoothly running down their balance sheet, but given other parts of the market liquidity ledger, it is not smooth. In the chart below, we have incorporated the Fed balance sheet, the Repo market and the General Account.

When the Fed expands its balance sheet, they are injecting liquidity into the financial system. However, if it lands in the Repo market, which is back on the Fed balance sheet, it has not really reached the financial system. We are simplifying. As the Fed has started reducing their balance sheet, the reduction will likely be partially offset by a declining Repo market. Finally, the general ledger captures direct government spending. Put it all together, if the line is rising, that is more accommodative, and if falling, then restrictive.

The equity market does not follow the stimulus line perfectly because the world is not that simple. There are many, many more factors. However, the stimulus does appear to be a BIG factor which can be seen in the often-directional moves between stimulus and the market. The bad news is the trend in the cumulative stimulus is to the downside in the months and quarters ahead, albeit not in a straight line. At some point, this relationship will soften, but for now, the market does appear to remain hooked on stimulus/liquidity in both directions.

The market is pretty happy the Fed has indicated it is appropriate to start slowing rate hikes. This is a market- friendly statement, certainly better than the alternative. However, it is the future data that will dictate whether the pace will slow and when rates will peak. Beyond the words and wishing for better data, the stimulus is set to decline more in the months ahead.

Market Cycle – holding in there

Here is our quick synopsis of the world. The global economy has been slowing or even contracting a little in spots as we near the end of 2022. The weak points include China which has been handling Covid with a policy that does hurt their economy, plus the real estate industry continues to reset. And then Europe, hindered by slowing global trade and also the impact of the war. Canada has been doing better, but we are slowing, with our heavy weighting towards real estate. Then there is the biggest economy, America. The U.S. economy is more insulated than most, essentially because they consume so much domestically. And the U.S. economy has remained stronger than most.

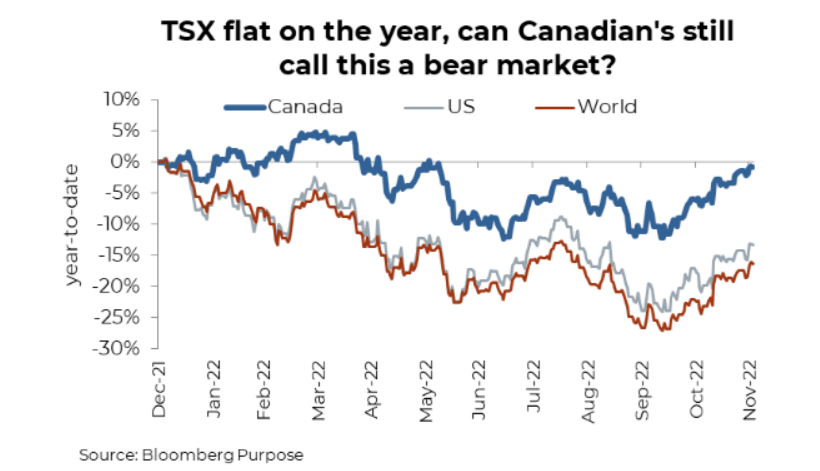

Equity markets have fallen substantially this year (not the TSX but most others) on rapidly rising yields as inflation became a bit out of control. This has been all multiple contractions, pushing valuations to attractive levels with the caveat that earnings revisions are now negative and there is a potential broader economic slowdown on the horizon (or a recession). A slower economy is bad but given inflation remains arguably the biggest issue for markets, that dark cloud does have a silver lining.

These are all known knowns. The questions remain about the severity of the economic slowdown, the path for earnings and, of course, inflation. There are a few changes to our market cycle indicators that may provide some insight:

U.S. Economy – it is starting to slow. They are still probably the best of class, but the momentum is rolling over. Leading indicators have rolled over with a magnitude that usually is associated with a drop-in economic activity. That is literally why it is called the ‘Leading Indicators.’ Among the broader indicators, we have seen the Phili Coincident indicators turn bearish along with consumer sentiment. Plus, on the manufacturing side, PMIs also turned bearish. No signals moved from bearish to bullish during the month. The U.S. economy is starting to slow.

Global Economy – After months in the dumps, mainly due to China and Europe, there are signs of improvement. China’s economy has been long suffering under their Covid policy, and the policy now is certainly seeing a backlash. We are not going to guess at their policy path, but the pressure to loosen restrictions is certainly growing. And the real estate deflating may be starting to improve. We track all real estate developers, and they have seen a sizeable bounce, along with the equity market. Encouraging. Europe, which is likely in a recession, has seen some improvement as well.

Among the indicators, Oil moved to bearish, but Baltic and EM improved to bullish. And worth noting among the indicators, five are improving, with only three deteriorating. Encouraging.

Fundamentals – Valuations have obviously been encouraging for a while now, but we have seen earnings revisions to the downside. That is still the case in the U.S. and Canada, but interestingly, things have improved globally. Both from an earnings growth perspective and revisions.

Portfolio Construction

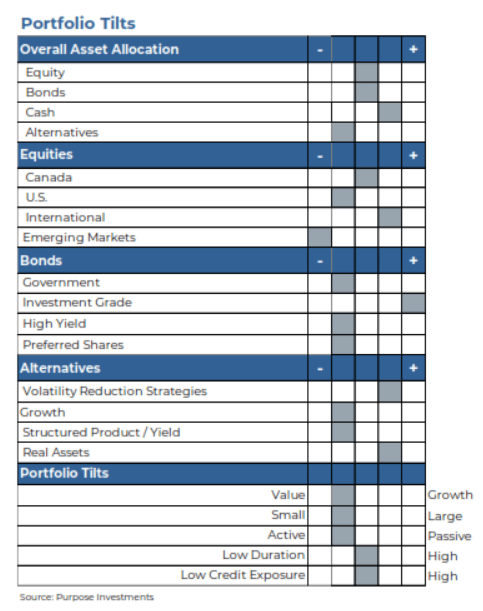

On the margin, we are a bit more cautious on risk assets, given the rally we have seen since mid-October. But must also acknowledge this is a seasonally strong period for markets, as is January, especially for smaller caps which includes the TSX. This market is starting to price in too much good news that may or may not show up in reality. For now, we are holding the line with previous allocations.

That has us neutral weighting for equities and bonds with a bit more cash and little less alternatives. Less U.S. equity, market-weight in Canada, and an overweight in international developed markets. Very little emerging market exposure. Bonds, with a market weight, are now leaning into investment grade. Our duration is just a bit under 5.

We do believe this ‘bear’ market is working its way through the process of resetting the market cycle. Leadership does appear to be changing, and at some point, a new bull will emerge. We fear that it is not this current bounce

and more weakness lies ahead in 2023, less from inflation angst and more from recession/earnings. We are remaining decently defensive with an eye to the next bull.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

— Brett Gustafson is a Portfolio Analyst at Purpose Investments

— Derek Benedet is a Portfolio Manager at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only. This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional

advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.